ABSTRACT

Accounting Conservatism (AC) is a fundamental concept in financial reporting, advocating for prudence in the recognition of financial information. Despite its critical role, there has been limited bibliometric analysis on AC research. This study addresses this gap by evaluating the evolution, current trends and future directions of AC research through a comprehensive bibliometric analysis. The research objectives are to identify prevailing research trends and citation patterns in the field of AC, explore key themes and influential works, assess the applicability of Lotka’s Law to AC research and propose future research directions based on the findings. By providing a detailed bibliometric analysis, this research offers valuable insights into the development of AC literature, highlights significant contributors and informs stakeholders about emerging trends and potential research gaps. The study employed a systematic approach to analyze 403 documents retrieved from the Scopus database using the search term “accounting conservatism.” Data were cleaned and harmonized, and bibliometric analysis was conducted using tools including Microsoft Excel, Open Refine, VOSviewer and biblioMagika. VOSviewer was utilized to map research networks and visualize key themes. The analysis reveals a significant increase in AC publications since 2000, with 89% published as articles in English. Major contributors include the US, China, Australia, Canada and the UK. Influential works by Khan and Watts (2009) and Kim and Zhang (2016) were identified, alongside notable authors such as Anwer S. Ahmed and Gerald J. Lobo. Key themes include “Conditional Accounting Conservatism,” “Information Asymmetry,” and “Unconditional Accounting Conservatism.” Lotka’s Law was applied, illustrating concentrated productivity among select authors, paralleling the principles of AC. This study enhances the understanding of AC research trends and provides practical implications for financial reporting and regulatory practices. It also suggests areas for future research, including the exploration of additional databases and emerging AC themes.

INTRODUCTION

Accounting Conservatism (AC) has long been a fundamental principle in financial reporting, ensuring that companies exercise caution in recognizing revenues and assets while promptly acknowledging liabilities and losses.[1] This principle plays a crucial role in mitigating information asymmetry between stakeholders and protecting investors by providing a more conservative view of a firm’s financial health.[2,3] In today’s increasingly volatile global economy, the relevance of AC is more pronounced as it serves to maintain stability and reduce risk in financial statements, particularly in uncertain markets.[3,4] However, the debate around the continued application of AC has intensified following the International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) conceptual frameworks that reduced its prominence after 2010.

This evolving landscape highlights the importance of considering cultural values, reporting rules and practices, which are closely linked to the accounting principle of conservatism as reflected in a countries and a company’s financial reporting standards. Even if all countries or companies adopt the same financial reporting standards (harmonization), the subjective nature of these standards can lead to variations in their application due to cultural differences.[5] For instance, when applying a rule that mandates the recognition of a contingent loss when its realization is deemed “probable,” accountants in more conservative countries or companies may set a lower probability threshold compared to those in less conservative environments. Additionally, cultural differences can influence the application of financial reporting rules in areas that require estimation and judgment, such as warranty expenses, bad debt expenses, revenue recognition, asset impairment tests and obsolete inventories.

Accounting conservatism plays a crucial role in financial reporting by determining accounting policies and their flexibility. It is vital in applying policies correctly, given its inherent caution towards potential future risks and losses. This principle helps protect against such risks and influences several key areas:

Estimating Flexibility in Choosing Accounting Policies: Conservatism limits the flexibility in choosing accounting policies, which can otherwise allow management to manipulate profits. This limitation benefits all parties by ensuring more consistent and reliable financial reporting.[6]

Quality of Disclosure Evaluation: The application of conservative accounting policies enhances the quality of disclosures, providing clear information about the accounting policies and assumptions used in financial estimates.

Identifying Risk Areas: Accounting conservatism assists in identifying risk areas in accounting policies and estimates, such as unjustified changes, unexplained profit increases, abnormal rises in customer accounts and inventory and discrepancies between profits and operating cash flows.

Benefits for Contracting Parties: By reducing information asymmetry, accounting conservatism benefits management, shareholders and creditors by promoting transparency in financial reports.

Avoiding Legal Costs: Conservatism helps companies avoid potential legal costs that may arise from overvaluing assets, thereby mitigating financial risks.

Historically, AC was regarded as a safeguard for financial reporting, particularly in periods of economic instability or uncertainty, where the understatement of net assets or earnings was preferred over overstatement.[7] However, recent developments in global accounting practices have called for a revaluation of AC, particularly in light of the shift toward more neutral and fair value accounting approaches.[8] While the debate around conservatism continues, its role in contemporary financial reporting must be better understood to ensure that decision-makers balance the benefits of prudence with the need for transparent and unbiased financial information.

In this context, AC is not merely a historical relic but an evolving tool in the modern corporate environment. Its ability to mitigate risk, enhance investor protection and reduce litigation exposure makes it a critical consideration for accountants, auditors, regulators and policymakers. Moreover, in the context of a rapidly digitizing economy and increasing corporate accountability, accounting conservatism is also central to ensuring that financial disclosures are reliable and resilient against market shocks.[9,10]

Despite the vast body of research on accounting conservatism, there remains a gap in the literature regarding the broader intellectual structure of AC studies. While several bibliometric analyses have explored various aspects of accounting research, limited attention has been given to understanding the overall landscape of AC research. Bibliometric studies are valuable tools that help map the development of a field, identify research trends and guide future inquiry. According to,[11] bibliometric analysis offers a systematic approach to evaluating the breadth and depth of scientific literature, providing scholars with critical insights into research productivity, collaboration patterns and key thematic areas within a discipline. Notably, there is a dearth of bibliometric research pertinent to accounting conservatism, necessitating a comprehensive analysis to explore associated behavioural patterns.

Before initiating the study, a primary search inquiry titled: “accounting conservatism” and “bibliometric” was conducted to gauge the extent of previous exploration of this topic through bibliometric analysis. Subsequently, additional research on Google Scholar using the same keywords yielded two prior studies. These findings underscore the urgency of conducting a bibliometric analysis of accounting conservatism.

While scant bibliometric analyses on accounting conservatism studies have previously been undertaken, the rapid growth in scientific work on this topic may have been overlooked. Hence, it is imperative to thoroughly examine the current status of activities related to accounting conservatism studies using established literature databases. Furthermore, this study extends existing knowledge by investigating many bibliometric traits neglected in earlier research efforts. Notably, there has been a consistent increase in accounting conservatism studies until January 2024. To date, two notable bibliometric studies have delved into this realm. Previous studies by[12,13] and employed bibliometric techniques to analyse AC research, with[12] analysing 408 documents from Scopus and[13] focusing on 354 documents from Web of Science. Both studies provide valuable insights into publication trends and geographical distribution, but their scope remains limited in terms of deeper thematic analysis and examination of AC’s intellectual structure. To build on these foundational works, this study extends the bibliometric analysis by incorporating a broader range of datasets and focusing on previously underexplored aspects such as collaboration networks, authorship patterns and the application of Lotka’s Law in AC research.

This study seeks to explore the following Research Questions (RQs):

- What are the prevailing publication trends in the field of accounting conservatism?

- What are the existing citation patterns for publications on accounting conservatism?

- Which themes related to accounting conservatism reporting are most frequently examined by scholars?

- Who are the most prolific authors in the field of accounting conservatism?

- What is the current state of collaboration in research on accounting conservatism?

- What is the authorship pattern in publications on accounting conservatism and how does this distribution align with Lotka’s Law?

- What is the intellectual structure of current research on accounting conservatism?

This investigation contributes significantly to the literature on accounting conservatism by offering a comprehensive analysis of its research development over the past three decades. It provides a roadmap for future research, highlighting key methodologies, concepts, influential journals, institutions and authors that shape the field. This study is valuable to stakeholders, such as policymakers and academics, as it informs the development of regulations and standards in financial reporting. Additionally, the bibliometric analysis offers a fresh perspective, organizing the existing knowledge on accounting conservatism and providing a structured understanding of its trajectory.

The primary aim of this research is to assess the evolving trends in accounting conservatism and offer insights into its current and future directions. This analysis equips researchers with a comprehensive understanding of the field and provides a tool to forecast key contributors and future research trajectories, ensuring its ongoing relevance for scholars and practitioners.

Previous studies have not fully examined individual contributions to the development of accounting conservatism. To address this, our study applies Lotka’s Law to analyse authorship distribution and productivity, marking the first integration of this bibliometric framework within the context of accounting conservatism research.

This research is structured into five main portions: introduction, review of related work, methodology, results and interpretations and discussion of issues and challenges. Each section plays a vital role in providing a thorough understanding of accounting conservatism. By examining published documents on AC within the Scopus database, this study aims to generate insights and inspire future research in the field.

REVIEW OF LITERATURE

Accounting Conservatism

Fundamental Definitions and Concepts posits that conservatism in accounting favors the recognition of positive economic outcomes (“good news”) in earnings while being less responsive to negative economic outcomes (“bad news”). As stated by,[3,14] conservatism involves systematically reducing the recorded value of assets relative to their market value over consecutive periods.[15] further elaborate that conservatism influences the selection of accounting standards, aiming to moderate reported earnings by accelerating expense recognition and delaying revenue recognition. This emphasis on financial statement quality assists stakeholders in allocating resources efficiently, thereby enhancing investment effectiveness.[16,17]

Conservatism also acts as a deterrent against managerial opportunism by discouraging investments in projects with negative net present values or returns and by thwarting the practice of deferring losses for future offset. Additionally, it improves reporting accuracy, reduces information asymmetry and addresses investment inefficiencies[18–21] and define conservatism as asymmetrical verification standards for gains and losses, requiring more rigorous verification for gains than for losses, thereby mitigating managerial opportunism. Some scholars describe conservatism as intentionally understating the book-value of net assets contrasted to market-value, narrowing the knowledge gap between managers and external shareholders.[16,22]

Conservatism, as defined by FASB (1980), is a prudent response to uncertainties, promoting careful assessment of risks and uncertainties. Conversely,[23,24] and characterize conservatism as a deliberate use of accounting methods and estimates to maintain a comparatively lower book value of net assets.[25] define conservatism as a picking of accounting treatments and methods that may result in undervaluation of assets or overvaluation of liabilities.

Factors Affecting Accounting Conservatism

Numerous factors influence accounting conservatism, as evidenced in prior studies. According to,[26] law, legislation, institutions and market demand shape conservatism.[27] further identifies positive effects on accounting conservatism from factors such as “leverage, litigation risk, financial distress, political cost and company growth”.

Leverage

The total debt-to-equity ratio represents a critical factor in creditor assessments, potentially leading to inflated profit reporting due to conflicting interests between managers and creditors. High leverage prompts closer creditor monitoring, advocating for accounting conservatism. Despite some inconsistency in research results, leverage has been shown to positively affect accounting conservatism.[27–29]

Litigation Risk

Earnings manipulation can arise from conflicts of interest between agents and principals, potentially leading to lawsuits. Accounting conservatism is often employed to mitigate the risk of legal disputes. Numerous studies consistently demonstrate a substantial and beneficial impact of litigation risk on AC.[27,30–32]

Financial Distress

Political Cost

Company Growth

High-profit businesses may seek to lower revenues by using accounting conservatism to fend off external demands. The AC constantly has a strong corelation with the growth of the company.[27]

Types of Accounting Conservatism

Accounting conservatism is categorized into two primary types: unconditional and conditional. Unconditional conservatism, or ex ante conservatism, involves conservative accounting practices applied regardless of the nature of future information. Examples include immediate expensing of internally developed intangibles, accelerated depreciation of assets and historical cost accounting for positive net present value projects. This form of conservatism often leads to a downward bias in reported income and asset values, potentially reducing decision-making efficiency and contracting effectiveness.[20,26]

In contrast, conditional conservatism, or ex post conservatism, adjusts book values based on the nature of new information. It involves recognizing losses promptly under adverse conditions while delaying the recognition of gains under favorable conditions. Examples include lower of cost or market accounting for inventory and impairment accounting for assets. Conditional conservatism addresses information asymmetry between insiders and outsiders, promotes efficient resource allocation and facilitates timely corrective actions.[3,35] Unlike unconditional conservatism, it supports decision-making and contracting efficiency by providing relevant information and minimizing wealth transfers between managers and capital providers.[36]

Results of Accounting Conservatism

Research on Accounting Conservatism (AC) highlights its dual role in both mitigating information asymmetry and influencing the financial stability of firms. Quantitative studies, such as those by,[3,14,15] and have empirically demonstrated that AC reduces information asymmetry between managers and non-management shareholders by providing a conservative, risk-averse view of the firm’s financial status. This prudence is particularly beneficial for lenders, as it aids in assessing borrower credibility and identifying potential default risks early, thus potentially lowering lending costs.[9,10] Furthermore, quantitative research by[37,38] and underscores the role of AC in improving the decision-making process for stakeholders, particularly in contexts where there is high financial uncertainty.

On the other hand, qualitative research provides insight into the broader implications of AC on firm stability and financial reporting practices.[39] argues that AC can introduce bias into financial statements, potentially harming the stability and continuity of profits by deferring the recognition of gains and accelerating losses. This approach may lead to conservative financial outcomes that, while reducing risk, could also cause underreporting of profits, especially during periods of high tax rates. Additionally, qualitative studies by,[40–42] and suggest that in the absence of stringent accounting controls, AC could inadvertently foster fraudulent activities, as managers may manipulate financial outcomes to defer recognition of liabilities or inflate asset values. Overall, the body of research on AC emphasizes its significant impact on improving financial transparency and stakeholder confidence, while also highlighting potential risks associated with its application, particularly in environments with weak governance frameworks.

METHODOLOGY

Study Design and Objective

The approach employed in this investigation is based on systematic techniques used to gather and organize data until it is complete, stable and ready for analysis. Before reaching this stage, it was essential to clearly define the subject and scope of the investigation in line with the study’s goals. This analysis primarily focuses on accounting conservatism papers that are accessible in the Scopus database. Scopus was selected for its renowned status as the largest abstract and indexing database and its distinction as the largest searchable repository for citation and abstract literature searches. This selection is substantiated by the research of.[11,43–46]

Search Strategy

The data for the current research were retrieved from the Scopus database on January 20, 2024. To focus on relevant publications, specific search criteria were used: the term “accounting conservatism” was applied to locate all pertinent publications. Table 1 presents a thorough elucidation of the investigation strategy. The primary aim of the search query was to locate literature pertaining to accounting conservatism. The search term used was TITLE (“Accounting Conservatism”) AND (EXCLUDE (PUBYEAR, 2024)).

| Research Protocol | Details |

|---|---|

| Database | Scopus Database |

| Years | 1994-2023 (29 Years) |

| Time | 20 Jan 2024 |

| Categories | All Categories |

| Search words | TITLE (“accounting conservatism”) AND (EXCLUDE (PUBYEAR, 2024)) |

| Languages | All Languages |

| Document type | All types of documents |

| Population | 403 |

| Data included for analysis | 413 |

| Analysis software | “Microsoft Excel, Openrefine, BiblioMagika and VOSviewer” |

Data Collection, Data Cleaning and Harmonisation

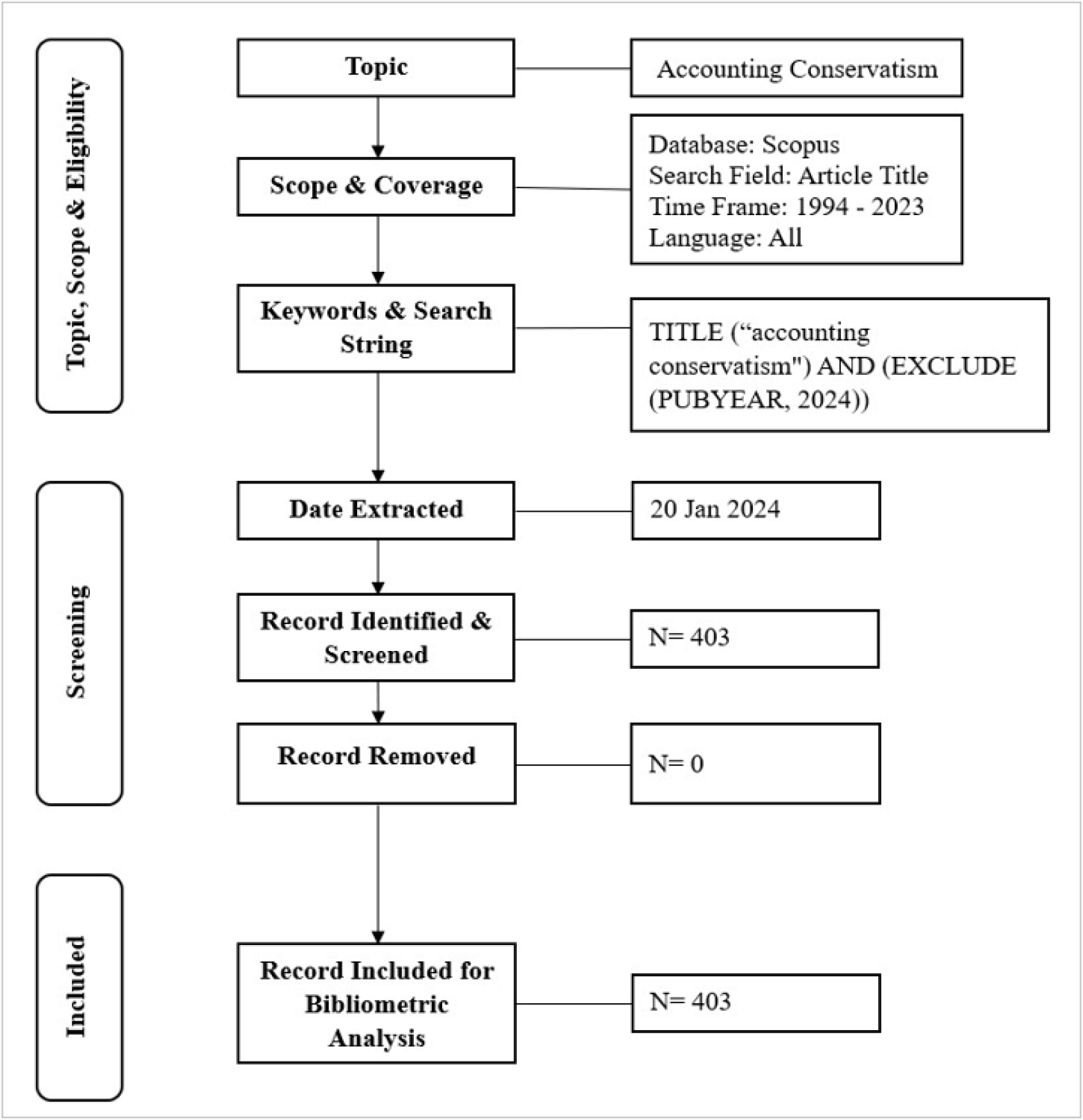

Given the scarcity of studies on the bibliometric analysis of accounting conservatism, we selected publications related to accounting conservatism based solely on their titles. Initially, our search yielded a total of 403 documents. After conducting various data cleaning processes, we found no duplicate papers and ended up with a final dataset of 403 documents. However, the data were saved from the Scopus database in either comma-separated values (.csv) or research information systems (.ris) formats. The research procedure, illustrated in Figure 1, served as a guide for selecting the documents for this study.

Figure 1:

Flow diagram of the search strategy.

Bibliometric Analysis and Software Tools

This study utilized a bibliometric approach to examine research patterns in accounting conservatism. The database provided comprehensive publishing information, including “document type, publication year, language, topic area, source title, keywords, abstract, country, affiliation, citations and Lotka Law”. Microsoft Excel, Open Refine, VOSviewer and biblioMagika were the software tools used for data filtering, harmonization, gathering and visualization. VOSviewer was specifically used for mapping analysis. This program employs two standardized weights to graphically depict the nodal network: the number of connections and the cumulative strength of connections. The dimensions of the network and the interconnecting lines offer valuable insights into the importance and robustness of the connections.[45–48]

RESULTS

The examination of scholarly publications obtained from the Scopus database encompassed many attributes, such as the annual growth in publications, the document and source types, the languages employed, the subject areas, the keyword analysis, the distribution of publications by country, the authorship analysis and the examination of titles, abstracts and citations. Additionally, the statistics highlighted the publications increasing percentage and frequency for each year up to end of 2023.

Current Trends in Accounting Conservatism Literature

To explore Research Question 1 (RQ1), which examines the current publication trends in accounting conservatism, a comprehensive analysis was conducted. This investigation encompassed multiple facets of the publication trend, including the annual volume of publications, types and origins of documents, languages used, covered subject areas, leading countries of activity, influential journals, authors and affiliations.

The Growth of Studies in Accounting Conservatism

The initial step in a Scientometrics study involves an analysis of publication distribution across different periods. The presentation of these findings sheds light on the significance of a subject and the point at which it initially attracted scholars’ attention. The annual publication count within a specific research domain can serve as a metric for accumulating new knowledge and identifying scholarly emphases. Therefore, the volume of publications within a particular field function as a critical gauge of its developmental trajectory.

Table 2 summarizes the annual publication details on accounting conservatism from 1994 to end of 2023. The earliest investigation into accounting conservatism, according to the Scopus database, dates back to 1994. This study, titled “Adverse Public Policy Implications of the Accounting Conservatism Doctrine: The Case of Premium Rate Regulation in the HMO Industry,” was featured in the JAPP (i.e., Journal of Accounting and Public Policy). Notably, 2020 witnessed a significant surge in published works, totalling 49 documents (12%). Additionally, the Table illustrates the growth of research articles on accounting conservatism over the past three decades. The highest average number of citations per publication manifest in 2009, with a total of 1360 citations, averaging 226.7 citations per publication. Conversely, documents published in 1994 received the lowest average citations per publication (5.00). Notably, publication activity on accounting conservatism began to surge in 2012.

| Year | TP | NCA | NCP | TC | C/P | C/CP | h | g | m |

|---|---|---|---|---|---|---|---|---|---|

| 1994 | 1 | 3 | 1 | 5 | 5.0 | 5.0 | 1 | 1 | 0.032 |

| 2000 | 2 | 4 | 2 | 58 | 29.0 | 29.0 | 2 | 2 | 0.080 |

| 2001 | 1 | 3 | 1 | 67 | 67.0 | 67.0 | 1 | 1 | 0.042 |

| 2002 | 2 | 6 | 2 | 940 | 470.0 | 470.0 | 2 | 2 | 0.087 |

| 2004 | 2 | 3 | 2 | 43 | 21.5 | 21.5 | 2 | 2 | 0.095 |

| 2005 | 1 | 1 | 1 | 40 | 40.0 | 40.0 | 1 | 1 | 0.050 |

| 2006 | 3 | 6 | 3 | 55 | 18.3 | 18.3 | 3 | 3 | 0.158 |

| 2007 | 5 | 10 | 5 | 792 | 158.4 | 158.4 | 5 | 5 | 0.278 |

| 2008 | 7 | 15 | 7 | 1244 | 177.7 | 177.7 | 5 | 7 | 0.294 |

| 2009 | 6 | 17 | 5 | 1360 | 226.7 | 272.0 | 5 | 6 | 0.313 |

| 2010 | 14 | 28 | 12 | 701 | 50.1 | 58.4 | 10 | 14 | 0.667 |

| 2011 | 11 | 24 | 7 | 178 | 16.2 | 25.4 | 4 | 11 | 0.286 |

| 2012 | 17 | 42 | 15 | 680 | 40.0 | 45.3 | 11 | 17 | 0.846 |

| 2013 | 23 | 64 | 19 | 804 | 35.0 | 42.3 | 9 | 23 | 0.750 |

| 2014 | 17 | 47 | 16 | 629 | 37.0 | 39.3 | 10 | 17 | 0.909 |

| 2015 | 26 | 59 | 22 | 1144 | 44.0 | 52.0 | 13 | 26 | 1.300 |

| 2016 | 14 | 36 | 13 | 1164 | 83.1 | 89.5 | 10 | 14 | 1.111 |

| 2017 | 26 | 74 | 22 | 347 | 13.3 | 15.8 | 9 | 18 | 1.125 |

| 2018 | 23 | 63 | 22 | 345 | 15.0 | 15.7 | 13 | 18 | 1.857 |

| 2019 | 29 | 74 | 23 | 272 | 9.4 | 11.8 | 11 | 15 | 1.833 |

| 2020 | 49 | 138 | 44 | 521 | 10.6 | 11.8 | 14 | 21 | 2.800 |

| 2021 | 37 | 102 | 34 | 335 | 9.1 | 9.9 | 10 | 17 | 2.500 |

| 2022 | 43 | 116 | 36 | 203 | 4.7 | 5.6 | 7 | 12 | 2.333 |

| 2023 | 44 | 123 | 22 | 79 | 1.8 | 3.6 | 5 | 7 | 2.500 |

| Total | 403 | 1058 | 336 | 12006 | 29.8 | 35.7 | 1 | 0 | 0.032 |

Document and Source Types

An additional examination was conducted to explore the various sources and documents utilized in published studies on accounting conservatism. As depicted in Table 3, the majority (88.34%) of accounting conservatism studies are published as articles, followed by conference papers (5.46%) and review papers (2.98%). Book chapters (1.74%), Erratum (0.74%), notes (0.5%) and retractions (0.25%) documents were also identified.

| Document Type | Total Publications (TP) | Percentage (%) |

|---|---|---|

| Article | 356 | 88.34% |

| Conference Paper | 22 | 5.46% |

| Review | 12 | 2.98% |

| Book Chapter | 7 | 1.74% |

| Erratum | 3 | 0.74% |

| Note | 2 | 0.50% |

| Retracted | 1 | 0.25% |

| Total | 403 | 100% |

Based on the collected and analysed data, these documents were categorized into four sources: journals, conference proceedings, book series and books (refer to Table 4). Out of 403 documents, 93.55% were published in journals, 3.97% in conference proceedings, 1.99% in book series and 0.50% in books.

| Source Type | Total Publications (TP) | Percentage (%) |

|---|---|---|

| Journal | 377 | 93.55% |

| Conference Proceeding | 16 | 3.97% |

| Book Series | 8 | 1.99% |

| Book | 2 | 0.50% |

| Total | 403 | 100% |

Languages of Documents

Understanding the language of research aids in comprehending the solutions provided to significant issues and facilitates the reading of academic publications. The datasets acquired were analysed to determine the predominant language used in published documents. According to Table 5, the dominant language used in publications on accounting conservatism is English, accounting for 99.01% of the publications. A small percentage of publications are available in other languages, including Portuguese (0.74%) and Chinese (0.50%). However, it is noteworthy that only one publication was prepared in multiple languages simultaneously. Despite English being the dominant scholarly language, it does not necessarily imply that the authors originate from English-speaking countries.

| Language | Total Publications (TP)* | Percentage (%) |

|---|---|---|

| English | 399 | 99.01% |

| Portuguese | 3 | 0.74% |

| Chinese | 2 | 0.50% |

| Total | 404 | 100% |

Subject Area

Subsequently, Table 6 provides a synopsis of the publications organised by their respective subject areas. Research on accounting conservatism is related to economics and business, and it has been found that 79.16% of the publications were categorised under the Business, Management and accounting areas. Afterwards are economics, econometrics and finance (58.06%), social sciences (12.16%), computer science (5.21%) and decision sciences (4.71%). Other topics with less than 4% of all published documents were Arts and Humanities, Engineering, Environmental Science, Mathematics, Agricultural and Biological Sciences, Energy, Multidisciplinary, Earth and Planetary Sciences, Biochemistry, Genetics and Molecular Biology, Pharmacology, Toxicology and Pharmaceutics, Psychology, Medicine and Physics and Astronomy.

| Subject Area | Total Publications (TP) | Percentage (%) |

|---|---|---|

| Business, Management and Accounting | 319 | 79.16% |

| Economics, Econometrics and Finance | 234 | 58.06% |

| Social Sciences | 49 | 12.16% |

| Computer Science | 21 | 5.21% |

| Decision Sciences | 19 | 4.71% |

| Arts and Humanities | 18 | 4.47% |

| Engineering | 18 | 4.47% |

| Environmental Science | 13 | 3.23% |

| Mathematics | 8 | 1.99% |

| Energy | 7 | 1.74% |

| Agricultural and Biological Sciences | 6 | 1.49% |

| Multidisciplinary | 6 | 1.49% |

| Earth and Planetary Sciences | 4 | 0.99% |

| Biochemistry, Genetics and Molecular Biology | 3 | 0.74% |

| Pharmacology, Toxicology and Pharmaceutics | 3 | 0.74% |

| Psychology | 2 | 0.50% |

| Medicine | 1 | 0.25% |

| Physics and Astronomy | 1 | 0.25% |

Most Active Source Titles

In recent years, computing advancements have accelerated progress in bibliometrics. Previously, the evaluation of journals was hindered by a lack of measures, but today, a plethora of metrics offer editors a more comprehensive view of a journal’s impact compared to its peers.

Scopus employs two citation metrics, SNIP (Source Normalized Impact per Paper) and SJR (SCImago Journal Ranking), to gauge journal impact. SNIP considers the field of journal publishing, accounting for differences such as citation rates, article volume and publication speed. SJR, on the other hand, factors in the reputation of the citing journal, assigning weights based on whether citations come from highly ranked sources.

Additionally, new indicators like the g-index, introduced by,[49] have emerged. Addressing the limitation of the h-index, which remains static once a paper enters the top h papers, the g-index continuously credits highly cited works. It represents the largest number such that the top g publications collectively receive at least g^2 citations, emphasizing the significance of impactful research.

Another alternative, the m-index, provides an average h-index per year since an author’s first publication. Unlike the h-index, which tends to favor longer careers, the m-index enables fair comparisons among authors of varying career lengths by considering research output over time.

The h-index, which first came up by,[50] assesses the influence of academic contributions by taking into account the number of citations received rather than the total number of publications. We quantify the author’s influence by calculating the number of publications in their body of work that have received a minimum of h citations.

Furthermore, studies on accounting conservatism have been disseminated across various publications. Notably, the JBFA (i.e., Journal of Business Finance and Accounting) leads in both publication count and citations, with 19 publications garnering 467 citations. Meanwhile, the JAE (i.e., Journal of Accounting and Economics) tops the list in total citations, with 2474, despite having fewer publications. These insights, detailed in Table 7, offer a snapshot of the landscape surrounding accounting conservatism research.

| Source Title | TP | Publisher | Cite Score 2023 | SJR 2023 | SNIP 2023 | NCA | NCP | TC | C/P | C/CP | h | g | m |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Journal of Business Finance and Accounting | 19 | Wiley-Blackwell | 4.40 | 1.28 | 1.83 | 49 | 17 | 467 | 24.58 | 27.47 | 11 | 19 | 0.611 |

| Contemporary Accounting Research | 18 | Wiley-Blackwell | 6.20 | 3.09 | 2.81 | 49 | 18 | 1664 | 92.44 | 92.44 | 12 | 18 | 0.706 |

| Accounting Review | 13 | American Accounting Association | 5.80 | 4.64 | 3.19 | 35 | 11 | 1430 | 110.00 | 130.00 | 10 | 13 | 0.435 |

| European Accounting Review | 10 | Taylor and Francis | 7.00 | 1.26 | 2.01 | 26 | 10 | 379 | 37.90 | 37.90 | 8 | 10 | 0.421 |

| Review of Accounting Studies | 9 | Springer Nature | 7.90 | 5.48 | 3.68 | 24 | 8 | 662 | 73.56 | 82.75 | 6 | 9 | 0.250 |

| Journal of Accounting and Economics | 9 | Elsevier | 8.70 | 8.34 | 4.12 | 19 | 9 | 2474 | 274.89 | 274.89 | 8 | 9 | 0.444 |

| Journal of Applied Business Research | 8 | CIBER Institute | 0.60 | 0.12 | 0.21 | 18 | 6 | 42 | 5.25 | 7.00 | 4 | 6 | 0.211 |

| Review of Quantitative Finance and Accounting | 8 | Springer Nature | 3.20 | 0.55 | 0.95 | 22 | 8 | 127 | 15.88 | 15.88 | 7 | 8 | 0.368 |

| Journal of Accounting and Public Policy | 8 | Elsevier | 4.80 | 1.33 | 1.81 | 20 | 8 | 134 | 16.75 | 16.75 | 5 | 8 | 0.161 |

| Journal of Accounting, Auditing and Finance | 8 | SAGE | 4.20 | 0.85 | 1.70 | 19 | 8 | 124 | 15.50 | 15.50 | 6 | 8 | 0.333 |

| Journal of Accounting Research | 7 | Wiley-Blackwell | 7.80 | 6.63 | 3.46 | 18 | 7 | 1421 | 203.00 | 203.00 | 7 | 7 | 0.412 |

| Accounting and Finance | 7 | Wiley-Blackwell | 5.10 | 0.82 | 1.32 | 15 | 6 | 265 | 37.86 | 44.17 | 6 | 7 | 0.400 |

| Journal of Contemporary Accounting and Economics | 7 | Elsevier | 6.00 | 0.74 | 1.47 | 21 | 7 | 146 | 20.86 | 20.86 | 4 | 7 | 0.250 |

| Cogent Business and Management | 5 | Cogent OA | 4.40 | 0.57 | 1.15 | 18 | 5 | 55 | 11.00 | 11.00 | 3 | 5 | 0.600 |

| Advances in Accounting | 5 | Emerald Publishing | 2.50 | 0.42 | 0.86 | 14 | 5 | 67 | 13.40 | 13.40 | 4 | 5 | 0.235 |

| Asian Review of Accounting | 5 | Emerald Publishing | 3.20 | 0.41 | 1.15 | 16 | 4 | 74 | 14.80 | 18.50 | 3 | 5 | 0.176 |

| Australian Accounting Review | 4 | Wiley-Blackwell | 6.30 | 0.82 | 1.43 | 6 | 4 | 113 | 28.25 | 28.25 | 4 | 4 | 0.400 |

| Managerial Auditing Journal | 4 | Emerald Publishing | 5.40 | 0.76 | 1.59 | 11 | 4 | 45 | 11.25 | 11.25 | 3 | 4 | 0.333 |

| International Journal of Innovation, Creativity and Change | 4 | Primrose Hall Publishing Group | N/A | N/A | N/A | 10 | 1 | 1 | 0.25 | 1.00 | 1 | 1 | 0.167 |

| China Journal of Accounting Studies | 4 | Taylor and Francis | 0.70 | 0.23 | 0.45 | 14 | 4 | 18 | 4.50 | 4.50 | 3 | 4 | 0.250 |

Most Productive Countries

In the domain of accounting conservatism, scholars and researchers from 49 nations have contributed to the corpus of publications sourced from the Scopus database. Table 8 provide an overview of the leading countries in terms of their substantial output in accounting conservatism literature. The Table underscores the leading contributors to research in this field. The US emerges as the frontrunner across all metrics, boasting the highest number of publications, citations and h-index. Significantly, it consistently maintains a high average number of citations per publication and each referenced article, with 131 selected articles garnering 8148 citations. Close behind is China, with 85 articles and 1404 total citations to its credit. While Australia, Canada and the United Kingdom exhibit moderate to high numbers of publications and citations, their h-indices pale in contrast to those of the United States and China. Specifically, Australia, Canada and the UK have respectively published 30, 25 and 24 articles, as depicted in Table 8. Overall, the analysis shows that China is the second-most productive nation in accounting conservatism research, with other countries highlighting varying levels of productivity and impact. Moreover, countries like Hong Kong and Singapore underscore the potential for significant impact despite their lower publication counts.

| Country | TP | NCP | TC | C/P | C/CP | h | g | m |

|---|---|---|---|---|---|---|---|---|

| United States | 131 | 128 | 8148 | 62.20 | 63.66 | 38 | 90 | 1.23 |

| China | 85 | 68 | 1404 | 16.52 | 20.65 | 19 | 37 | 1.19 |

| Australia | 30 | 27 | 917 | 30.57 | 33.96 | 16 | 30 | 0.94 |

| Canada | 25 | 24 | 595 | 23.80 | 24.79 | 12 | 24 | 0.57 |

| United Kingdom | 24 | 24 | 552 | 23.00 | 23.00 | 12 | 23 | 0.75 |

| Indonesia | 21 | 12 | 58 | 2.76 | 4.83 | 4 | 7 | 0.44 |

| South Korea | 20 | 17 | 217 | 10.85 | 12.76 | 7 | 14 | 0.29 |

| Iran | 20 | 11 | 58 | 2.90 | 5.27 | 4 | 7 | 0.29 |

| Hong Kong | 17 | 15 | 1096 | 64.47 | 73.07 | 10 | 17 | 0.77 |

| Jordan | 15 | 11 | 62 | 4.13 | 5.64 | 3 | 7 | 0.33 |

| Taiwan | 14 | 12 | 249 | 17.79 | 20.75 | 9 | 14 | 0.53 |

| Malaysia | 11 | 11 | 133 | 12.09 | 12.09 | 5 | 11 | 0.38 |

| Tunisia | 11 | 8 | 48 | 4.36 | 6.00 | 5 | 6 | 0.50 |

| Iraq | 9 | 6 | 73 | 8.11 | 12.17 | 3 | 8 | 0.38 |

| Spain | 9 | 8 | 990 | 110.00 | 123.75 | 8 | 9 | 0.44 |

| Portugal | 8 | 7 | 44 | 5.50 | 6.29 | 4 | 6 | 0.80 |

| Brazil | 6 | 4 | 22 | 3.67 | 5.50 | 4 | 4 | 0.24 |

| Greece | 6 | 4 | 113 | 18.83 | 28.25 | 4 | 6 | 0.33 |

| Viet Nam | 5 | 4 | 22 | 4.40 | 5.50 | 3 | 4 | 0.60 |

| Egypt | 5 | 4 | 78 | 15.60 | 19.50 | 3 | 5 | 0.27 |

| United Arab Emirates | 5 | 5 | 64 | 12.80 | 12.80 | 3 | 5 | 0.25 |

| Japan | 5 | 5 | 93 | 18.60 | 18.60 | 4 | 5 | 0.27 |

| India | 4 | 4 | 40 | 10.00 | 10.00 | 3 | 4 | 0.38 |

| Singapore | 4 | 4 | 299 | 74.75 | 74.75 | 4 | 4 | 0.20 |

| New Zealand | 3 | 3 | 27 | 9.00 | 9.00 | 2 | 3 | 0.17 |

Most Productive Affiliations

A total of 467 different institutes have contributed to the publication of studies on accounting conservatism. Table 9 provides a breakdown of the affiliations with the most publications and the total number of publications attributed to each affiliation. As depicted in Table 9, the most productive institutions are located in the USA and Germany. The top 20 affiliations are listed for clarity. Islamic Azad University in Iran emerges as the most productive affiliation in research on accounting conservatism, with 13 published documents. Following closely is the University of Texas in Austin, United States, with 11 publications. Furthermore, Shanghai University in China and the University of Massachusetts in the United States each have a total of 8 published documents, highlighting their active contribution to academic research. However, in terms of total citations, the Massachusetts Institute of Technology surpasses others with 1453 citations.

| Institution Name | Country | TP | NCP | TC | C/P | C/CP | h | g | m |

|---|---|---|---|---|---|---|---|---|---|

| Islamic Azad University | Iran | 13 | 5 | 9 | 0.69 | 1.80 | 2 | 3 | 0.143 |

| University of Texas | US | 11 | 10 | 338 | 30.73 | 33.80 | 8 | 11 | 0.333 |

| Shanghai University | China | 8 | 6 | 137 | 17.13 | 22.83 | 4 | 8 | 0.400 |

| University of Massachusetts | US | 8 | 8 | 388 | 48.50 | 48.50 | 6 | 8 | 0.500 |

| Massachusetts Institute of Technology | US | 7 | 6 | 1453 | 207.57 | 242.17 | 6 | 7 | 0.353 |

| University of Houston | US | 7 | 7 | 468 | 66.86 | 66.86 | 7 | 7 | 0.467 |

| California State University | US | 6 | 6 | 41 | 6.83 | 6.83 | 3 | 6 | 0.176 |

| La Trobe University | Australia | 5 | 5 | 105 | 21.00 | 21.00 | 5 | 5 | 0.385 |

| Oklahoma State University | US | 5 | 5 | 69 | 13.80 | 13.80 | 4 | 5 | 0.333 |

| Universiti Teknologi MARA | Malaysia | 5 | 5 | 76 | 15.20 | 15.20 | 3 | 5 | 0.231 |

| Universidad Carlos III de Madrid | Spain | 5 | 5 | 827 | 165.40 | 165.40 | 5 | 5 | 0.278 |

| Zarqa University | Jordan | 5 | 4 | 15 | 3.00 | 3.75 | 3 | 3 | 0.500 |

| Xiamen University | China | 5 | 5 | 244 | 48.80 | 48.80 | 4 | 5 | 0.267 |

| Wuhan University | China | 5 | 5 | 71 | 14.20 | 14.20 | 4 | 5 | 0.500 |

| Southwestern University of Finance and Economics | China | 4 | 4 | 57 | 14.25 | 14.25 | 4 | 4 | 0.571 |

| Hong Kong Baptist University | Hong Kong | 4 | 3 | 37 | 9.25 | 12.33 | 2 | 4 | 0.154 |

| University of Aveiro | Portugal | 4 | 4 | 13 | 3.25 | 3.25 | 3 | 3 | 0.600 |

| Murdoch University | Australia | 4 | 4 | 324 | 81.00 | 81.00 | 4 | 4 | 0.364 |

| Sun Yat-sen University | China | 4 | 4 | 53 | 13.25 | 13.25 | 3 | 4 | 0.375 |

| York University | Canada | 4 | 4 | 317 | 79.25 | 79.25 | 4 | 4 | 0.211 |

| Sichuan University | China | 4 | 1 | 14 | 3.50 | 14.00 | 1 | 3 | 0.143 |

| University of Illinois | US | 4 | 4 | 324 | 81.00 | 81.00 | 4 | 4 | 0.167 |

| University of Navarra | Spain | 4 | 4 | 808 | 202.00 | 202.00 | 4 | 4 | 0.222 |

| Boston University | US | 4 | 4 | 29 | 7.25 | 7.25 | 3 | 4 | 0.167 |

| Saint Louis University | US | 4 | 4 | 459 | 114.75 | 114.75 | 2 | 4 | 0.143 |

Citation Analysis

To address the second research question (What are the current citation patterns of publications on tax evasion?), we analysed the citations of the documents as follows: citation metrics and highly cited articles. Additionally, this section presents visualisations generated from VOSviewer regarding collaborations between countries based on citations and the number of documents. The data for this research were obtained using bibliographic information from the Scopus database.

The citation metrics for the papers collected as of January 20, 2024, are summarised in Table 10, which illustrates the yearly number of citations. Over a span of 29 years (1994-2023), 12055 citations were attributed to 338 published articles, averaging 415.69 citations per year.

| Main Information | Data |

|---|---|

| Publication Years | 1994-2023 |

| Total Publications | 403 |

| Citable Year | 29 |

| Number of Contributing Authors | 1058 |

| Number of Cited Papers | 338 |

| Total Citations | 12055 |

| Citation per Paper | 29.91 |

| Citation per Cited Paper | 35.67 |

| Citation per Year | 415.69 |

| Citation per Author | 11.39 |

| Author per Paper | 2.63 |

| Citation sums within h-Core | 11357 |

| h-index | 48 |

| g-index | 102 |

| m-index | 1.55 |

Moreover, Table 11 presents the most-cited papers according to the Scopus database, ranked by total citations for each document. At the forefront of scholarly attention stands the work titled “Estimation and empirical properties of a firm-year measure of accounting conservatism” authored by,[21] which has garnered 769 citations. Published in the Journal of Accounting and Economics by Elsevier, this article has averaged 48.06 citations per year. Close behind is “Accounting Conservatism and Stock Price Crash Risk: Firm-level Evidence,” authored by[51] and published in Contemporary Accounting Research by Wiley, cited 566 times.

| No. | Author(s) | Title | Source Title | TC | C/Y |

|---|---|---|---|---|---|

| 1 | Khan and Watts[21] | Estimation and empirical properties of a firm-year measure of accounting conservatism | Journal of Accounting and Economics | 768 | 48.00 |

| 2 | Kim and Zhang[51] | Accounting Conservatism and Stock Price Crash Risk: Firm-level Evidence | Contemporary Accounting Research | 565 | 62.78 |

| 3 | Penman and Zhang[23] | Accounting conservatism, the quality of earnings and stock returns | Accounting Review | 482 | 20.96 |

| 4 | Zhang[9] | The contracting benefits of accounting conservatism to lenders and borrowers | Journal of Accounting and Economics | 465 | 27.35 |

| 5 | Ahmed and Duellman[52] | Accounting conservatism and board of director characteristics: An empirical analysis | Journal of Accounting and Economics | 464 | 25.78 |

| 6 | Ahmed et al.,[53] | The role of accounting conservatism in mitigating bondholder-shareholder conflicts over dividend policy and in reducing debt costs | Accounting Review | 458 | 19.91 |

| 7 | Krishnan and Visvanathan[54] | Does the SOX definition of an accounting expert matter? The association between Audit committee directors’ accounting expertise and accounting conservatism | Contemporary Accounting Research | 365 | 21.47 |

| 8 | Ahmed and Duellman[55] | Managerial Overconfidence and Accounting Conservatism | Journal of Accounting Research | 360 | 30.00 |

| 9 | Lafond and Roychowdhury[35] | Managerial ownership and accounting conservatism | Journal of Accounting Research | 357 | 21.00 |

| 10 | García Lara et al.,[56] | Accounting conservatism and firm investment efficiency | Journal of Accounting and Economics | 334 | 37.11 |

| 11 | García Lara et al.,[57] | Accounting conservatism and corporate governance | Review of Accounting Studies | 306 | 19.13 |

| 12 | Francis et al.,[58] | Gender Differences in Financial Reporting Decision Making: Evidence from Accounting Conservatism | Contemporary Accounting Research | 297 | 29.70 |

| 13 | Ho et al.,[59] | CEO Gender, Ethical Leadership and Accounting Conservatism | Journal of Business Ethics | 260 | 26.00 |

| 14 | Nikolaev[60] | Debt covenants and accounting conservatism | Journal of Accounting Research | 235 | 15.67 |

| 15 | Hui et al.,[61] | Corporate suppliers and customers and accounting conservatism | Journal of Accounting and Economics | 234 | 18.00 |

| 16 | Kanagaretnam et al.,[62] | Influence of national culture on accounting conservatism and risk-taking in the banking industry | Accounting Review | 225 | 20.45 |

| 17 | Gigler et al.,[63] | Accounting conservatism and the efficiency of debt contracts | Journal of Accounting Research | 187 | 11.69 |

| 18 | Dietrich et al.,[64] | Asymmetric timeliness tests of accounting conservatism | Review of Accounting Studies | 183 | 10.17 |

| 19 | Chen et al.,[65] | Association between borrower and lender state ownership and accounting conservatism | Journal of Accounting Research | 162 | 10.80 |

| 20 | Ruch and Taylor[66] | Accounting conservatism: A review of the literature | Journal of Accounting Literature | 117 | 11.70 |

Exploring Keywords in Accounting Conservatism Studies

AC is an essential principal in the field of financial reporting, requiring adherence to standards that mandate rigorous verification and the selection of methods that provide conservative estimates in uncertain situations. This enduring concept aims to protect users of financial statements from inflated revenues and ensures the timely recognition of all potential liabilities upon their realization. Unravelling these complexities requires the adoption of innovative research methodologies. Among them, clustering analysis has proven effective, as this technique categorises data points into distinct clusters based on their similarities and interconnections, revealing the underlying structure of a dataset. As we address our third research question, our aim is to identify the dominant themes within the accounting conservatism literature that have attracted significant scholarly attention.

Moreover, beyond merely discovering the themes in accounting conservatism studies, we delve into the evolution of keywords over time, striving to unearth research gaps and detect hotspots in this area of study. Our goal in this section is to highlight the important issues that academics researching accounting conservatism frequently debate.

To accomplish this, we embarked on a keyword co-occurrence analysis using VOSviewer of the pertinent publications within the realm of accounting conservatism research. This process was preceded by rigorous cleaning and standardisation of all keywords (including both author’s keywords and indexed keywords) using OpenRefine, a vital preparatory measure instituted to ensure consistency throughout the dataset. VOSviewer, a dedicated software tool engineered for the construction and visualisation of bibliometric networks, was employed for the keyword analysis. The selection criteria adopted necessitated a minimum of two occurrences for a keyword and the implementation of the fractional counting method. Out of a total of 951 keywords, 171 met the threshold. With these parameters set, three distinct visualisations were generated: network, overlay and density visualisations.

These visualisations offer a dynamic lens to explore the intricate landscape of accounting conservatism research, facilitating a deeper understanding of the interconnections, areas of focus and emerging trends in the field. This allows for the identification of possible directions for future study. This investigation not only maps out the thematic territory of accounting conservatism research but also sets the stage for a comprehensive exploration of the discipline’s multifaceted dimensions.

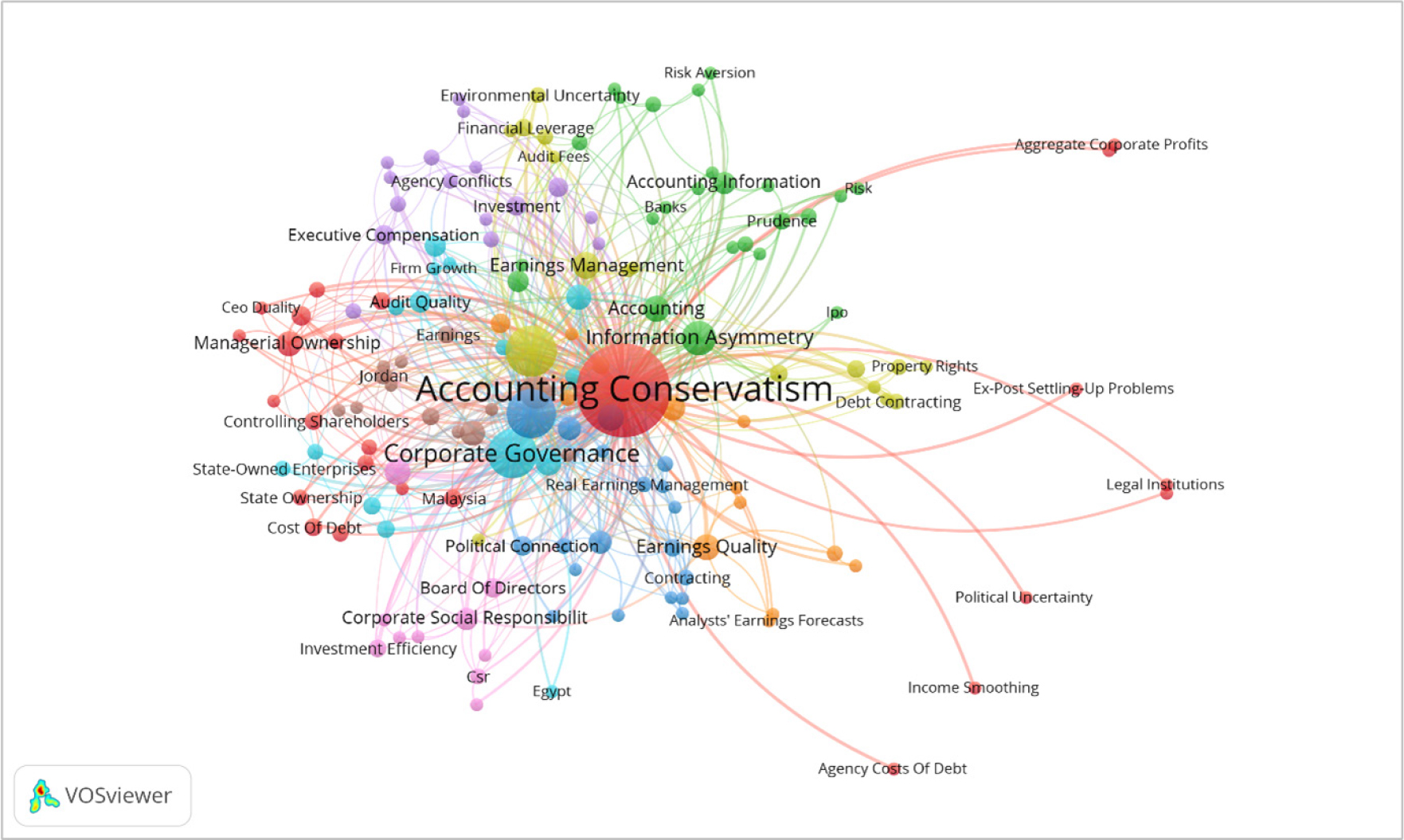

Network Visualization: A Thematic Dissection of Accounting Conservatism Studies

Network visualisation serves as an instrumental tool in manifesting the intricate relationships within complex datasets. By transposing numerical and textual data into comprehensible visual forms, it illuminates the relationships, interdependencies and groupings concealed within the data. The strength of these relationships is typically depicted through spatial proximity or line thickness connecting distinct entities, while unique colours discriminate the various clusters. In Figure 2, a colour-delineated thematic map is presented, with each shade representing a distinct cluster or research theme. Every cluster encompasses a variety of labels, each indicative of diverse thematic areas or facets of tax evasion under study. The analysis elucidates seven unique thematic clusters, each mirroring a distinct strand of focus within the broader literature.

Figure 2:

Network visualisation: A thematic dissection of accounting conservatism studies.

Cluster 1 (red colour): accounting conservatism, managerial ownership, institutional ownership, controlling shareholders, cost of debt, leverage, Malaysia, cost of equity, Earnings Per Share (EPS), financial performance, independent commissioner, ownership concentration, state ownership, agency costs of debt, aggregate corporate profits, CEO duality, income smoothing, legal institutions, litigation risk, monetary policy, political uncertainty, product market competition, shariah compliant. This cluster primarily examines the influence of ownership structure and external variables, including as legal institutions, political instability and market competitiveness, on accounting conservatism in the specific setting of Malaysia. It also explores financial performance metrics and the relationship between conservative accounting and various ownership-related variables.

Cluster 2 (green colour): information asymmetry, accounting, accruals, prudence, moral hazard, overconfidence theory, performance, uncertainty, ambiguity, banks, conceptual framework, debt market, duality, financial disclosure, financial statements, IPO, limited liability, loan loss provisioning, real options, risk, risk aversion, short selling, upper echelons theory. This cluster revolves around the concepts of information asymmetry, accounting principles and the role of uncertainty and risk in financial markets. It also touches on topics like IPOs, bank-related issues and the disclosure of financial information.

Cluster 3 (blue colour): conditional accounting conservatism, IFRS, asymmetric timeliness, audit committee, political connection, litigation, contracting, cost of capital, financial reporting quality, real earnings management, Tehran Stock Exchange (TSE), accounting standards, big N auditors, block holders, economic conditions, financial reports, intellectual capital, internal control, investor sentiment, value relevance. This cluster investigates the conditional elements of AC, such as the Impact of Accounting Standards (IFRS), audit committees and economic circumstances. Furthermore, it explores the intricacies of financial reporting quality and the significance of accounting values within the framework of the Tehran stock exchange.

Cluster 4 (yellow colour): conservatism, earnings management, agency theory, financial leverage, Indonesia, Australia, cost of equity capital, debt contracting, environmental uncertainty, audit fees, capital structure, covenant violation, high-tech, low-tech, management earnings forecast, property rights, spread. This cluster appears to focus on the connection relating conservatism, earnings management and agency theory. It also explores the impact of environmental uncertainty, capital structure and specific country contexts such as Indonesia and Australia.

Cluster 5 (purple colour): executive compensation, investment, risk-taking, agency conflicts, debt covenants, financial crisis, firm performance, good corporate governance, announcement returns, bank lending, cultural dimensions, firm size, Islamic bank, mergers and acquisitions, national culture, political cost. This cluster is centred around executive compensation, risk-taking and the impact of agency conflicts on firm performance. It also explores corporate governance, cultural dimensions and the effects of events like financial crises and mergers and acquisitions on accounting conservatism.

Cluster 6 (Cyan colour): corporate governance, China, agency costs, audit quality, timely loss recognition, emerging market, institutional investors, board independence, cash holdings, foreign ownership, investment decisions, state-owned enterprises, debt maturity, Egypt, firm growth. This cluster emphasizes the significance of corporate governance, audit quality and agency costs in emerging markets, particularly focusing on China and Egypt. Additionally, it examines the impact of institutional investors, board independence and foreign ownership on investment decisions and firm growth.

Cluster 7 (orange colour): earnings quality, financial reporting, agency problem, financial constraints, competition, managerial ability, analysts’ earnings forecasts, conservative accounting, financial analysis, internal control quality, market efficiency, religiosity, share repurchase. This cluster emphasises earnings quality, financial reporting and the role of internal controls in mitigating agency problems. It also explores the impact of competition, managerial ability and religiosity on financial analysis and market efficiency.

Cluster 8 (maroon colour): unconditional accounting conservatism, M41, board structure, earnings, Jordan, analyst forecast, Basu model, COVID-19, G3, industrial companies, international financial reporting standards, investor uncertainty, return. This cluster centres around unconditional accounting conservatism and its relationship with board structure, earnings and analyst forecasts. It also explores the impact of external factors such as COVID-19, international financial reporting standards and investor uncertainty.

Cluster 9 (pink colour): ownership structure, corporate social responsibility, board of directors, investment efficiency, CSR, earnings asymmetric timeliness, family firms, investor protection, managerial discretion, over-investment. This cluster focuses on the relationship between ownership structure, Corporate Social Responsibility (CSR) and investment efficiency. It also explores how family firms and investor protection influence managerial discretion and potential overinvestment.

In exploring the field of accounting conservatism through keyword clusters, it becomes evident that this area encompasses a broad spectrum of themes. The clusters highlight a global perspective, with a focus on specific countries such as Malaysia, Indonesia and China. The interplay of diverse variables, including ownership structures, financial metrics and external factors like political and economic conditions, underscores the complexity of accounting choices. The emphasis on corporate governance, risk management and financial reporting quality emerges consistently across clusters, suggesting the importance of effective governance mechanisms and reliable financial information. Cultural dimensions and ethical considerations are recognised, with themes like Islamic banking and corporate social responsibility gaining prominence. The research also emphasises the influence of various ownership structures on accounting practices. Overall, these clusters provide valuable insights for policymakers and practitioners, guiding future research endeavours and contributing to a better understanding of conservative accounting practices in different contexts.

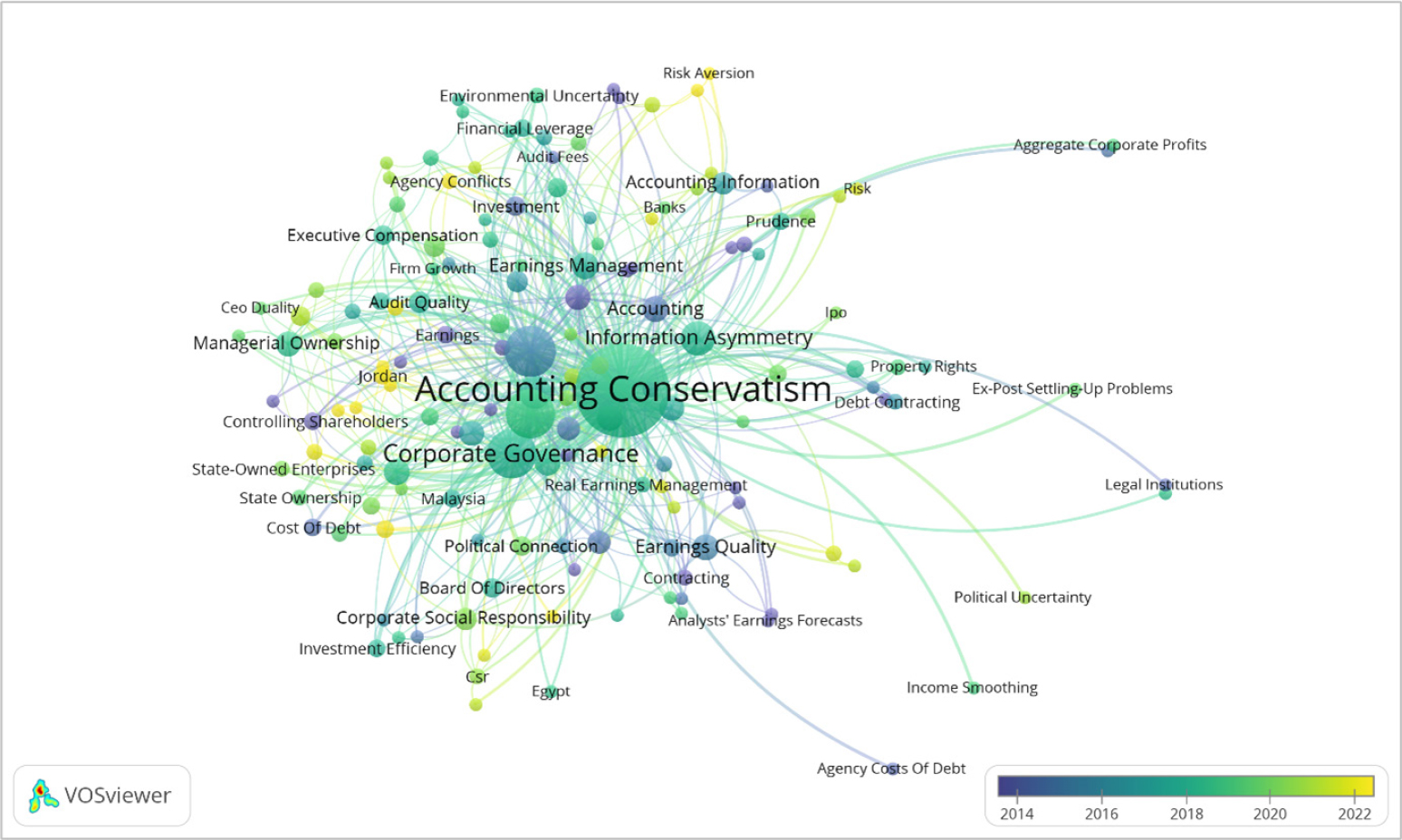

Overlay Visualisation: tracing the temporal evolution of accounting conservatism research

The discussion on overlay visualisation serves as a methodological linchpin in understanding the temporal evolution of research fields such as accounting conservatism. Utilising tools like VOSviewer, researchers can visualise the changing landscape of keywords over time. In the context of accounting conservatism research, overlay visualisation was employed to analyse the evolving significance of keywords, revealing dynamic trends and the vibrancy of the field. This technique sheds light on the ‘Information Asymmetry’ cluster, a critical aspect in the broader framework. This cluster elucidates how differences in information influence financial reporting decisions, emphasising the strategic adoption of conservative accounting practices. The visualisation not only highlights the dynamic nature of accounting conservatism but also prompts inquiries into market efficiency, transparency and the regulatory role in managing information disparities. It lays the groundwork for understanding why companies employ conservative accounting practices to enhance clarity and trust in financial reporting (see Figure 3).

Figure 3:

Overlay visualisation: Tracing the temporal evolution of Accounting Conservatism research.

Building on this, the exploration of the ‘Information Asymmetry’ cluster connects with the broader cluster of factors in accounting conservatism research. In Malaysia, new factors that are coming up are managerial ownership, institutional ownership, leverage, financial performance, ownership concentration, independent commissioners, Shariah compliance, CEO duality, litigation risk, income smoothing, political uncertainty, product market competition, monetary policy, the entrenchment effect, legal institutions and the agency costs of debt. These factors, interconnected and scrutinised through overlay visualisation, play pivotal roles in shaping financial reporting practices. The link between information asymmetry and these factors reveals the nuanced dynamics influencing financial reporting decisions in a specific country. It highlights the need for researchers exploring accounting conservatism in Malaysia to consider this intricate web of factors for a comprehensive understanding of the landscape.

Furthermore, the exploration of the broader cluster of terms in accounting conservatism research, including information asymmetry, accruals, prudence, overconfidence theory, uncertainty, risk aversion, loan loss provisioning, upper echelons theory and financial disclosure, provides a comprehensive understanding of motivations and implications in diverse organizational settings. Overlay visualisation aids in recognising the complex interplay of these terms and their influence on financial reporting decisions. For instance, the link between uncertainty and risk aversion in conservative accounting practices, especially in the banking sector, emphasises the role of these terms in shaping financial reporting choices. The interdisciplinary approach in accounting conservatism research, considering both specific factors in a country like Malaysia and broader terms in the field, enriches insights into financial reporting decisions across various organisational settings. Researchers can unravel the intricate relationships within this comprehensive framework to gain a holistic understanding of accounting conservatism.

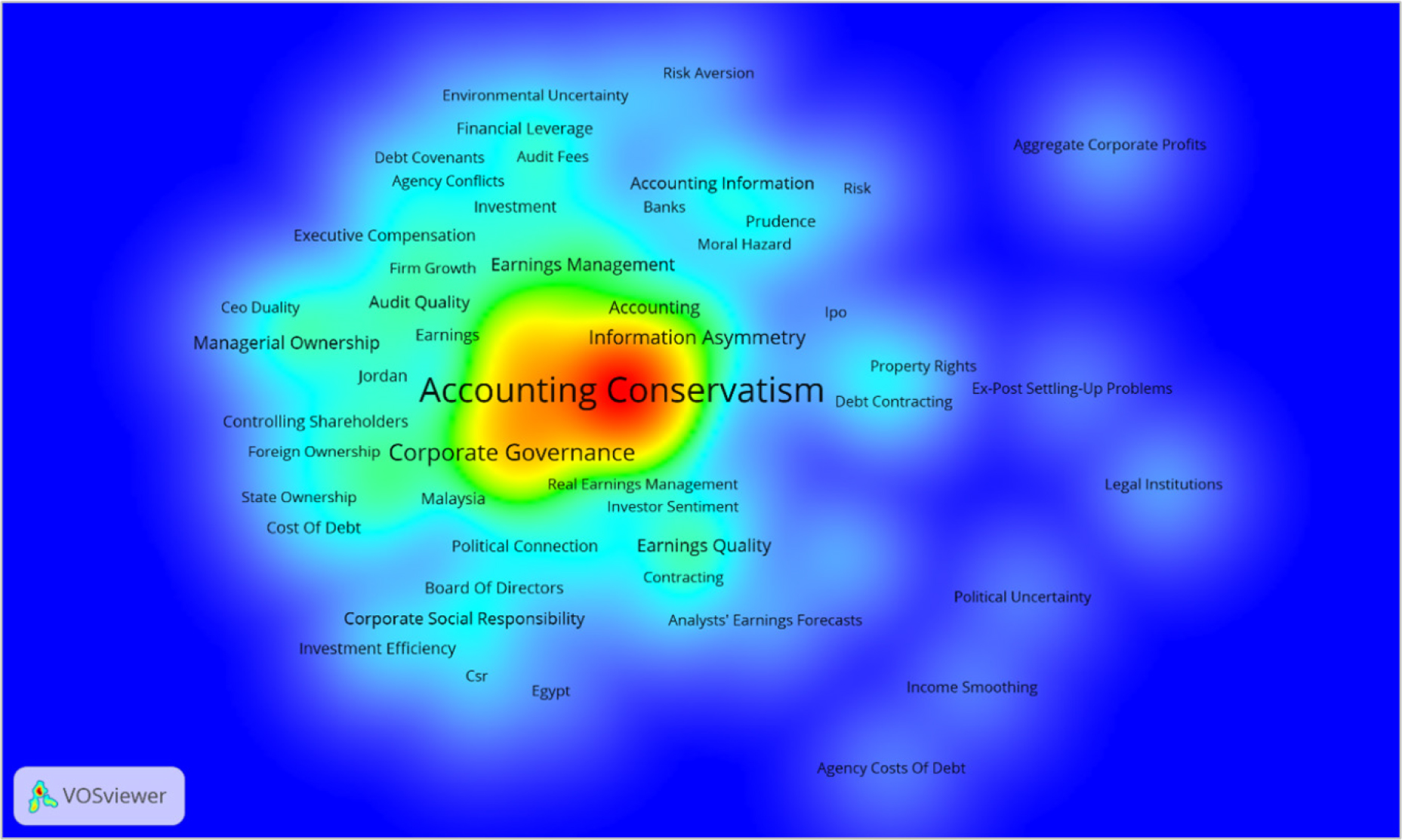

Density Visualisation: Illuminating Areas of Concentration in Accounting Conservatism Research

Understanding the scholarly environment associated with accounting conservatism research is crucial thanks to density visualization, a cutting-edge feature of bibliometric tools like VOSviewer. By graphically displaying the concentration of scholarly activity and assigning colours to different zones on a network map, density visualisation reveals the intensity of research in specific themes or keywords. “Hotter” regions, often depicted in red, indicate higher scholarly activity and research hotspots, while “cooler” regions, in blue or green, represent lesser activity (see Figure 4). This approach is instrumental in discerning research hotspots within the accounting conservatism literature, where the keyword “accounting conservatism” emerges as a significant hotspot, vividly represented in red.

Figure 4:

Density visualisation: illuminating areas of concentration in Accounting Conservatism research.

Density visualization makes it easy to connect the examination of “Information Asymmetry” in financial reporting with this spotlight on accounting conservatism. The visual representation of research hotspots underscores the significance of accounting conservatism as a central theme, echoing its fundamental nature in academic discourse. ‘Information asymmetry,’ a crucial element in accounting conservatism research, becomes more evident in this context. It reveals how companies, faced with uneven information distribution, adopt conservative accounting practices to be transparent and honest about their financial situations.

Moreover, the discussion extends to the increasing focus on “Conditional Accounting Conservatism and Unconditional Accounting Conservatism.” This growing interest in the nuanced details of conservative accounting practices aligns with the insights gained from density visualization. The visual representation not only emphasises the dynamic nature of accounting conservatism but also provides a roadmap for future investigations. The trend towards a more detailed and context-specific understanding of conservative accounting practices, as highlighted by density visualisation, resonates with the increasing scrutiny of specific conditions and situations influencing companies’ choices in adopting conservative practices.

In conclusion, the combination of density visualisation insights, exploration of ‘Information Asymmetry,’ and rising interest in “Conditional Accounting Conservatism and Unconditional Accounting Conservatism” creates a cohesive narrative. The visual aid helps researchers find important themes and hotspots in conservative accounting. The following discussions go into more detail about the practical implications, such as how companies deal with incomplete information and the specific factors that affect conservative accounting decisions. This comprehensive approach contributes to a more comprehensive understanding of AC, fostering transparency and reliability in financial reporting.

Exploring Authorship Patterns: Applicability of Lotka’s Law

Authorship And Co-Authorship Analysis

This study analyses current collaboration patterns and identifies influential authors in the field of accounting conservatism. Collaboration among scholars is a formal and integral aspect of scientific inquiry.[67] Global collaboration networks facilitate the involvement of less developed nations in the knowledge creation process traditionally dominated by more affluent countries.[68] The integration of diverse perspectives promotes the advancement and refinement of concepts, resulting in higher-quality publications characterized by reduced errors and contributions from interdisciplinary sources.[69]

The current study also identifies authors who have made significant contributions to the field of accounting conservatism. The most prolific authors are summarized in Table 12; each having published at least three works. According to the Table, Ahmed, Anwer S., Lobo, Gerald J., García Osma, Beatriz and Zhang, Feida stand out as prominent contributors, each having authored more than four articles on this topic. In terms of total citations received, Anwer S. Ahmed leads the list with 1436 citations, followed by Scott Duellman with 922 citations and García Osma, Beatriz with 827 citations.

| Full Name | Current Affiliation | Country | TP | NCP | TC | C/P | C/CP | h | g | m |

|---|---|---|---|---|---|---|---|---|---|---|

| Ahmed, Anwer S. | Texas A&M University | US | 6 | 6 | 1436 | 239.33 | 239.33 | 5 | 6 | 0.200 |

| Lobo, Gerald J. | University of Houston | US | 6 | 6 | 453 | 75.50 | 75.50 | 6 | 6 | 0.400 |

| García Osma, Beatriz | Universidad Carlos III de Madrid | Spain | 5 | 5 | 827 | 165.40 | 165.40 | 5 | 5 | 0.278 |

| Zhang, Feida | The University of Queensland | Australia | 5 | 5 | 337 | 67.40 | 67.40 | 5 | 5 | 0.455 |

| Duellman, Scott | Saint Louis University | US | 4 | 4 | 922 | 230.50 | 230.50 | 3 | 4 | 0.167 |

| Penalva, Fernando | University of Navarra | Spain | 4 | 4 | 808 | 202.00 | 202.00 | 4 | 4 | 0.222 |

| García Lara, Juan Manuel | Universidad Carlos III de Madrid | Spain | 4 | 4 | 808 | 202.00 | 202.00 | 4 | 4 | 0.222 |

| Pae, Jinhan | Korea University | South Korea | 4 | 4 | 83 | 20.75 | 20.75 | 4 | 4 | 0.190 |

| Kang, Tony | University of Nebraska | US | 4 | 4 | 48 | 12.00 | 12.00 | 2 | 4 | 0.167 |

| Alves, Sandra | University of Aveiro | Portugal | 4 | 4 | 13 | 3.25 | 3.25 | 3 | 3 | 0.600 |

| Krishnan, Gopal V. | Bentley University | US | 3 | 3 | 385 | 128.33 | 128.33 | 2 | 3 | 0.118 |

| Zuo, Luo | Cornell University | US | 3 | 2 | 201 | 67.00 | 100.50 | 2 | 3 | 0.167 |

| Riedl, Edward J. | Boston University | US | 3 | 3 | 188 | 62.67 | 62.67 | 2 | 3 | 0.111 |

| Chen, Jeff Zeyun | Texas Christian University | US | 3 | 2 | 178 | 59.33 | 89.00 | 2 | 3 | 0.133 |

| Chi, Wuchun | National Chengchi University | Taiwan | 3 | 3 | 90 | 30.00 | 30.00 | 3 | 3 | 0.188 |

| Ahmed, Kamran | La Trobe University | Australia | 3 | 3 | 89 | 29.67 | 29.67 | 3 | 3 | 0.231 |

| Zhong, Yuxiang | Huazhong University of Science and Technology | China | 3 | 3 | 62 | 20.67 | 20.67 | 2 | 3 | 0.250 |

| Jaggi, Bikki | Rutgers University | US | 3 | 3 | 55 | 18.33 | 18.33 | 2 | 3 | 0.167 |

| D’Augusta, Carlo | Bocconi University | Italy | 3 | 3 | 45 | 15.00 | 15.00 | 3 | 3 | 0.600 |

| Kung, Fan-Hua | Tamkang University | Taiwan | 3 | 2 | 44 | 14.67 | 22.00 | 2 | 3 | 0.118 |

| Al-Qudah, Laith Akram | Al-Balqa’ Applied University | Jordan | 3 | 2 | 30 | 10.00 | 15.00 | 2 | 3 | 0.667 |

| Hong, Soonwook | Konyang University | South Korea | 3 | 2 | 23 | 7.67 | 11.50 | 1 | 3 | 0.125 |

| Pereira, Claudia | Polytechnic of Porto | Portugal | 3 | 2 | 19 | 6.33 | 9.50 | 2 | 3 | 0.400 |

| Liang, Shangkun | Central University of Finance and Economics | China | 3 | 3 | 15 | 5.00 | 5.00 | 3 | 3 | 0.250 |

| Garkaz, Mansour | Islamic Azad University | Iran | 2 | 1 | 1 | 0.50 | 1.00 | 1 | 1 | 0.071 |

A comprehensive total of 1058 distinct authors have collectively contributed to 403 publications addressing accounting conservatism. Table 13 provides a breakdown of publication distribution by the number of contributing authors per document. As depicted, 34% of these publications were co-authored, while the remainder featured varying combinations of multiple and single authors. The majority of publications on accounting conservatism were co-authored by three authors (34%) and two authors (31%). The maximum number of authors involved in these publications reaches up to seven authors.

| Author Count | TP | Frequency |

|---|---|---|

| 1 | 62 | 15% |

| 2 | 123 | 31% |

| 3 | 138 | 34% |

| 4 | 69 | 17% |

| 5 | 8 | 2% |

| 6 | 1 | 0.25% |

| 7 | 2 | 0.50% |

| Grand Total | 403 | 100% |

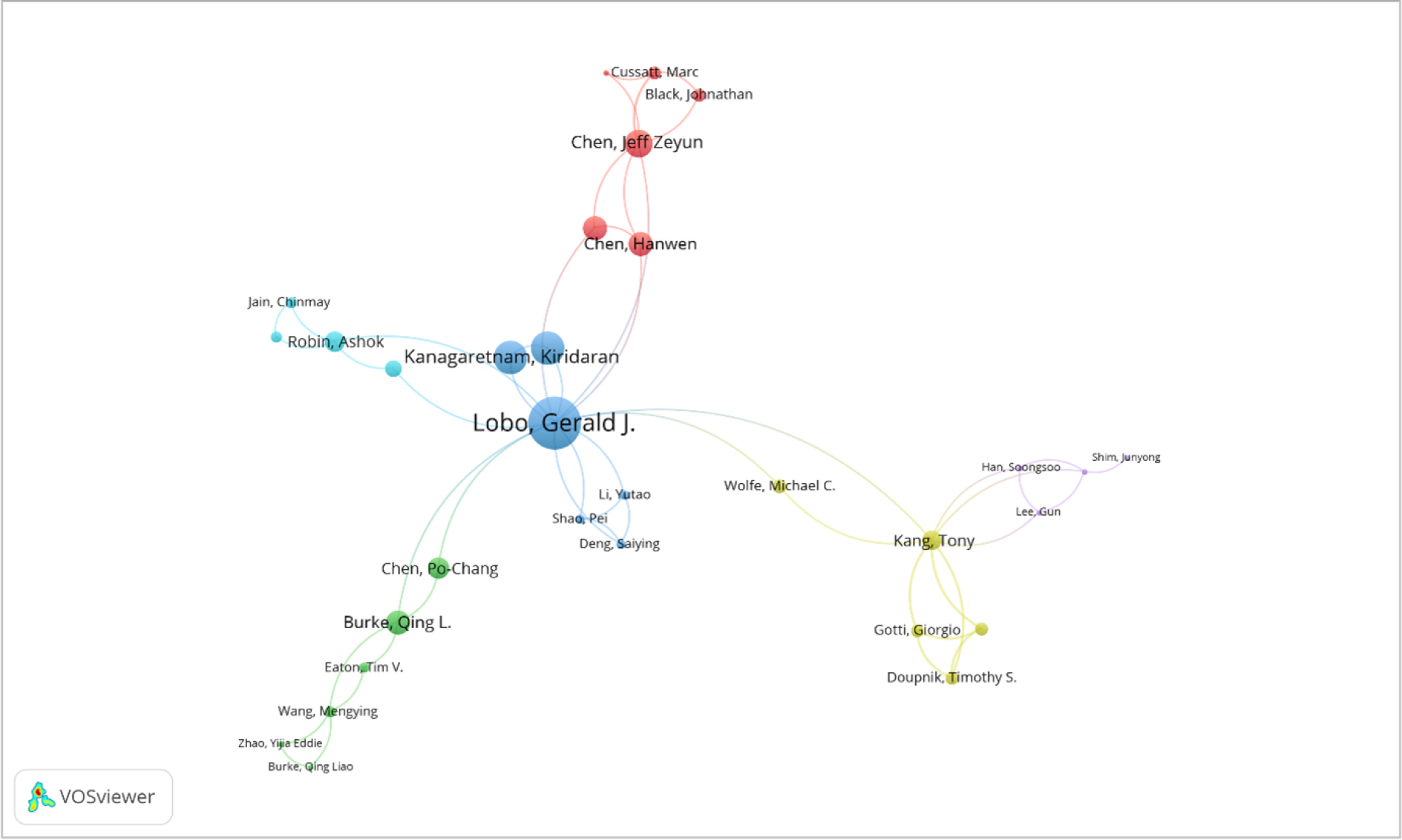

Furthermore, this study conducts an author collaboration analysis using VOSviewer, focusing on prominent authors with at least one citation, employing full-count methodologies. Given limitations in available literature and the prevalent tendency of authors to collaborate in small research groups, no strict thresholds were applied for the number of publications or citations. Author connections are represented through colour, circle size, font size and line thickness in the visualization. Authors sharing the same colour are frequently clustered together. The study identifies six distinct clusters encompassing a total of 31 items. In Cluster 3, depicted in blue (see Figure 5), six authors (Deng, Saiying; Kanagaretnam, Kiridaran; Li, Yutao; Lim, Chee Yeow; Lobo, Gerald J.; and Shao, Pei) collaborated closely and conducted joint research projects.

Figure 5:

Map of the co-authorship based on authors (Full Counting).

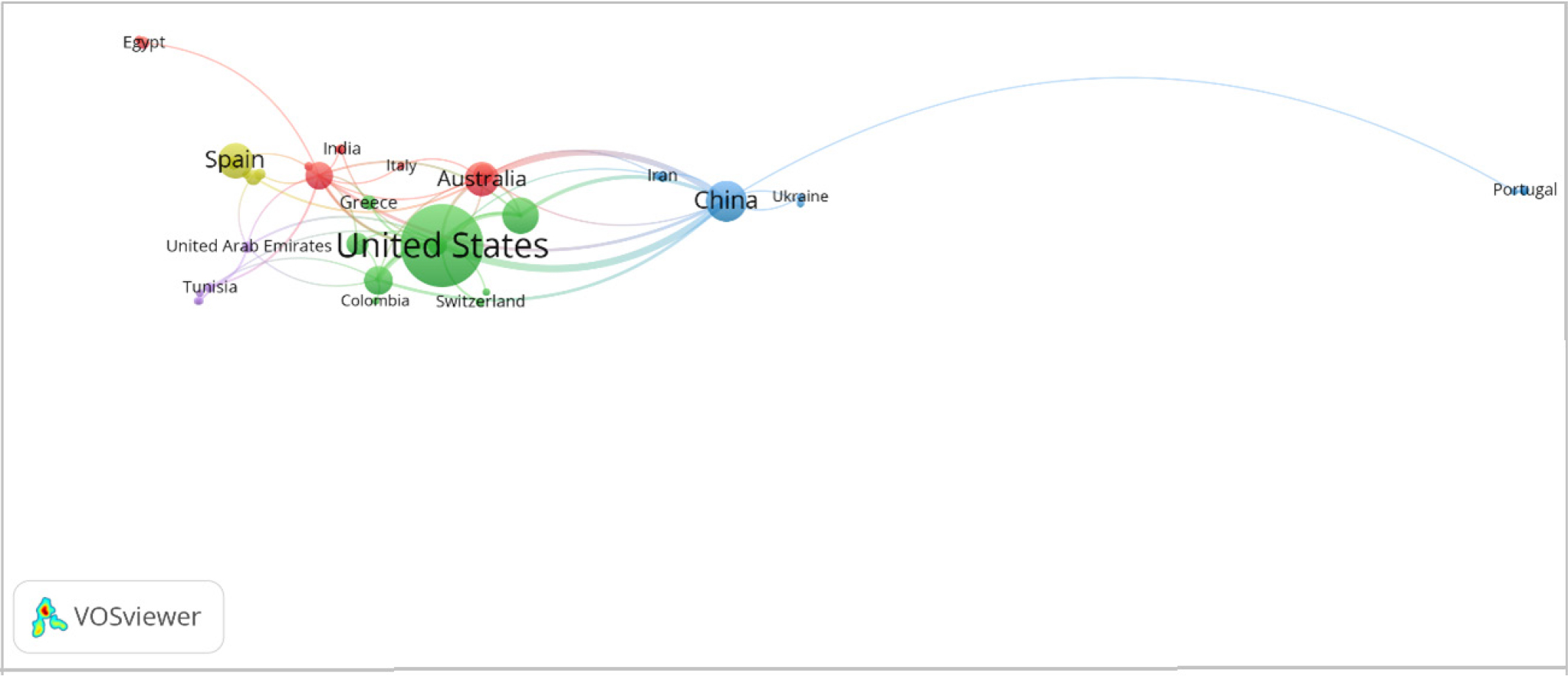

The network visualisation diagram in Figure 6 illustrates collaborative connections among authors based on their respective countries. This analysis specifically focuses on countries contributing more than one article and receiving more than one citation. The outcome reveals five distinct clusters. Using a comprehensive counting method, it is evident that the US plays a highly significant role in global collaboration with other nations. For instance, Cluster 3 coloured in Blue, China has established close collaborations with Iran, New Zealand, Oman, Pakistan, Philippines, Portugal and Ukraine. Similarly, Australia has engaged in collaborative efforts with Egypt, India, Italy, Palestine, Saudi Arabia, Taiwan, UK and Vietnam. Delving deeper into the findings, the US Cluster emerges as the leading contributor in terms of total publications, boasting 131 documents and 8148 citations. Following closely is the China cluster, with 85 publications and 1404 citations.

Figure 6:

Map of the co-authorship based on Countries (Full Counting).

Applying Lotka’s Law in Accounting Conservatism Research

To delve deeper into the complexities of co-authorship relationships, we utilize Lotka’s Law as an analytical framework. Lotka’s Law holds significant weight in bibliometric studies, as highlighted by scholars.[46,70] Introduced by,[71] the law postulates that the number of authors contributing n times to academic output is approximately 1/na of those contributing only once, where a typically equals two. This suggests a predictive relationship wherein the number of authors contributing a specific number of publications decreases proportionally as the number of papers they contribute increases. In essence, Lotka’s Law elucidates patterns of scientific productivity and the relationship between authors and their publication outputs by forecasting an author’s contributions to scholarly work.

Lotka conducted a systematic analysis of the data and observed distinct numerical patterns, revealing an uneven distribution of authors and articles. This led him to develop the concept of scientific output, which quantifies the number of publications authored by individual scholars over a defined period. Lotka’s formula, represented by Equation 1, expresses the frequency of authors making x contributions as y, with C as a constant. This formula serves as a fundamental tool for understanding scholarly production and authorship dynamics.

where “y” is the frequency of authors making x contributions each and “C” is a constant.

Upon review, it is evident that there is a paucity of research on the application of Lotka’s law to accounting conservatism within the current literature. While productivity patterns of authors have been analysed in various domains such as marine pollution, business reporting, supply chain management and biomedical literature, there has been no exploration of its application in the realm of accounting conservatism.[70] applied Lotka’s law to forecast and understand author productivity patterns and citations, thereby encouraging its adoption in other disciplines. This study extends this inquiry to include research on XBRL, highlighting the relevance of Lotka’s law in this specific context.

Despite the abundance of data on authorship in the accounting conservatism literature, achieving a comprehensive understanding of authorship patterns and trends remains challenging. Therefore, the current research employs Lotka’s law to forecast and analyse authors’ contributions. To thoroughly evaluate the applicability of Lotka’s law in accounting conservatism research, specific methods are employed.[72] recommends using parameter estimation techniques to assess the suitability of Lotka’s rule for this purpose. These parameters include n, C and CV (critical value).

Calculation of the exponent ‘n’ To evaluate Lotka’s law, the first step involves computing the exponent “n” using the linear least squares (LLS) method described by Eq. 2. Here, “N” denotes the number of data pairs analysed, “X” signifies the logarithm of “x,” and “Y” denotes the logarithm of “y”.

According to Table 14, the value of n is determined as:

| N | x | y | X | Y | XY | X^2 | X^n | 1/x^n |

|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 824 | 0.0000 | 6.7142 | 0.0000 | 0.0000 | 1.0000 | 1.0000 |

| 2 | 2 | 146 | 0.6931 | 4.9836 | 3.4544 | 0.4805 | 5.7414 | 0.1742 |

| 3 | 3 | 42 | 1.0986 | 3.7377 | 4.1062 | 1.2069 | 15.9593 | 0.0627 |

| 4 | 4 | 24 | 1.3863 | 3.1781 | 4.4057 | 1.9218 | 32.9636 | 0.0303 |

| 5 | 5 | 10 | 1.6094 | 2.3026 | 3.7059 | 2.5903 | 57.8606 | 0.0173 |

| 6 | 6 | 12 | 1.7918 | 2.4849 | 4.4524 | 3.2104 | 91.6285 | 0.0109 |

| Grand Total | 1058 | 6.5793 | 23.4010 | 20.1246 | 9.4099 | 205.1533 | 1.2954 |

Estimation of parameter ‘C’ The value of the constant ‘C‘ can be determined using the following equation:

Using the value n=2.5214, the value of C can be computed as:

Kolmogorov-Smirnov (K-S) statistical Test

In order to determine the suitability of Lotka’s law,[73] suggests using the K-S statistical test (see Table 15).

| Observed | Theoretical | ||||||

|---|---|---|---|---|---|---|---|

| N. of Pubs. | N. of Authors (yx) | % of Authors | Cum. % of Authors | Expected % of Authors | Cum. Expected % of Authors | ||

| x | y | yx/Σyx | Σ(yx/Σyx) | 1/xn | fe = C (1/xn) | Σfe | Dmax |

| 1 | 824 | 0.7788 | 0.7788 | 1.0000 | 0.7720 | 0.7720 | 0.0068 |

| 2 | 146 | 0.1380 | 0.9168 | 0.1742 | 0.1345 | 0.9065 | 0.0104 |

| 3 | 42 | 0.0397 | 0.9565 | 0.0627 | 0.0484 | 0.9548 | 0.0017 |

| 4 | 24 | 0.0227 | 0.9792 | 0.0303 | 0.0234 | 0.9783 | 0.0010 |

| 5 | 10 | 0.0095 | 0.9887 | 0.0173 | 0.0133 | 0.9916 | -0.0029 |

| 6 | 12 | 0.0113 | 1.0000 | 0.0109 | 0.0084 | 1.0000 | 0.0000 |

| Grand Total | 1058 | 1.0000 | 5.6200 | 1.2954 | 1.0000 | ||

The largest deviation, represented by the difference value Dmax, is 0.0068. The critical value for a significance level of α=0.01 is calculated using the formula outlined by.[74]

The critical value is calculated to be 0.0499. The distinction between the actual value of Dmax (0.0068) and the critical value (0.0499) shows that Dmax is less than the critical value (0.0499) at a significance level of 0.01. Thus, these data conform to Lotka’s rule with a value of n equal to 2.5214.

DISCUSSION

The primary objective of this study was to identify current trends in AC. The bibliometric analysis aimed to ascertain the direction of research in this field. Additionally, this paper tested Lotka’s law applicability and proposed future research areas within accounting conservatism. Bibliometric methods provide a means to evaluate research output and publication trends in a specific field.[75,76] suggests that bibliometric results can inform decisions regarding research funding allocation, assess the impact of scientific work and compare input-output relationships.

Furthermore, this investigation employed a predefined search query to retrieve 403 documents from a specified database. Among these documents, the Journal of Accounting and Public Policy (1994) published an article titled “Adverse public policy implications of the accounting conservatism doctrine: The case of premium rate regulation in the HMO industry,” authored by Judith M. Considine, Yaw M. Mensah and Leslie Oakes, marking an early exploration into accounting conservatism. Subsequently, from 2000 onwards, there has been a notable increase in publications and scholarly contributions addressing accounting conservatism.

Over 88% of the documents analysed are published as articles, highlighting a predominant emphasis on this format compared to other document types. Furthermore, 99% of these publications are in English, originating from 49 different countries. Leading contributors to research on accounting conservatism include the US, China, Australia, Canada and the UK. Publications on accounting conservatism are commonly found in journals covering Business, Management and Accounting, Economics, Econometrics and Finance, Social Sciences, Computer Science and Decision Sciences. In addition, key influential works identified in our analysis include those by,[21,51] which have significantly influenced discussions on accounting conservatism. Additionally, notable authors such as Anwer S. Ahmed, Gerald J. Lobo, García Osma, Beatriz and Feida Zhang have made substantial contributions to the field.

This study utilized citation matrices to assess the impact of publications on accounting conservatism. The citation metrics employed provide insights into the significance of articles in this field. Since 1994, a total of 403 articles on accounting conservatism have been published, accumulating over 12055 citations. On average, publications in the Scopus database related to accounting conservatism receive approximately 415.69 citations per year and 29.91 citations per paper.