ABSTRACT

Islamic capital market is one of the supporting pillars towards the fast growing of Islamic finance industry. Scholars paid high attention to it, resulting enormous studies being published to accelerate the development of Islamic capital market. This research tries to synthesize those published literatures and mapping the intellectual structure that has been formed and developed around the topic by focusing on the publication trends, key areas of the research, most contributing journals, most influential authors, and collaboration among countries. A bibliometric approach was conducted to achieve the desired result by using Scopus database where 1,336 documents had been successfully retrieved. The research found that there was an upward surge of publication since 2008 with several trending keywords over the years. In addition, two major publishers which have the most contributing journals towards the topic were discovered. We also found three most influential authors within the area. In addition, Malaysia has been noticed to put the highest effort in contributing to the topic while making the most collaboration. Lastly, there are three key highlights for the direction of future research and four implications based on the statistical findings. All these findings shed light and give a significant foundation for future research.

INTRODUCTION

One of the global banking industries with the fastest growth rates is the Islamic finance sector.[1] Islamic finance itself has started to show financial growth internationally with a presentation of 20-30% per year.[2] This is because Islamic finance has started to make a big difference in the real economy by doing well as a financial intermediary through collecting and moving money for investment activities.[3] In addition to that, efforts are being made to develop and improve the quality of the economy by growing the investment sector using capital market instruments.[4]

The Islamic capital market serves as an investment vehicle that is advantageous for development, making it both an indicator of economic growth and a significant economic milestone in a nation. The existence of the Islamic capital market has a significant impact on how the global financial system is structured.[5] Current economic growth has accelerated due to the presence of the Islamic capital market in the financial sector.[6] The Islamic capital market is gaining popularity not just in Muslim nations but across the globe, with an average annual growth rate of 10% to 15%.[7] The Islamic capital market additionally offers a fantastic opportunity to switch from a development process based on conventional financial replication to an approach that facilitates financing based on structures and services that originate from the concept of risk sharing in accordance with ethical principles derived from Islamic theology.[8]

The mechanism of the Islamic capital market is somewhat different from the familiar capital market. Economic agents are guided not only by the legal norms laid down in state statutes but also by the rules prescribed in the Qur’an.[9] The basic principle of financial investment is that the investor should invest his assets in accordance with the Islamic principles that govern his daily life. First, transactions must adhere to Islamic ethical norms as determined by the Islamic legal system, or Shari’a. Second, transactions must be carried out freely and fairly, but this freedom is still limited by sharia provisions.[10]

To satisfy the needs of issuers and investors, the Islamic capital market is active and provides a range of capital market products and services. Contrary to conventional instruments, Islamic capital market goods must abide by sharia principles in order to be traded on the Islamic capital market[11] even though researches are still in disagreement as to whether customer of Islamic finance industry are regilious or profit driven.[12,13] Islamic capital market instruments are Islamic tools meant to better serve Moslems’ demands and achieve financial and economic objectives.[14] The Islamic capital market uses mutual funds, Islamic equities, and Islamic bonds as its instruments. The future of the Islamic capital market is bright for these three products.[15]

The discussion in Islamic capital market is endless. Scholars tried to capture the phenomena in this field and build a comprehensive understanding regarding the topic. Several scholars tried to discuss the topic of Islamic equities as it has been mentioned above[16,17] others talk about Islamic mutual fund,[18] while others talk about Sukuk[19,20] or even in the sub topic of any these area such as Social Responsible Investment,[21] or in the sub topic of Social Development Goal.[22]

Despite of these abundant and always growing articles in Islamic capital market topic, we found no article that discussed the intellectual structure mapping in this field. We took note for several literature reviews in the topic in past few years[23–26] none of those articles came up with the mapping of the established body of knowledge within the field. We also took note that several studies[21,27,28] tried to make the mapping but only for specific topic within the field of Islamic capital market. Thus, it created a gap that need to be filled.

As part of the effort to contribute to the field, this study tries to close that gap. Particularly, this study aims to capture the publication trends, key areas of published literatures, most contributing journals, main figure of scholars and the main countries along with its cross-country collaborations in the field of Islamic capital market. To ensure that this research will be able to deliver the results, we use bibliometric analysis as the methodology. Bibliometric itself has been widely used to conduct research with similar purpose in various areas[29,30] or even specifically in the field of economics and finance.[31–33] The result of this study will bring benefits for researchers since it gives broader and a more general synthesized view over the existing body of literatures in the field of Islamic capital market.

LITERATURE REVIEW

Islamic capital market indeed has been an interesting discussion topic for many scholars. The abundance of articles within this field of topic demands scholars to make a comprehensive review on what researchers did in the last decade. It is imperative to do it to ensure that previous results won’t be gone unused but rather becoming cornerstone for the next research direction.

Among scholars that conducted literature study is Hassan et al.,[23] who made lengthy summary on the dynamic discussion of Islamic capital market topic. However, the article didn’t focus only on the Islamic capital market but instead have another two main discussion which are Islamic finance-growth nexus, and Islamic real estate finance. It was found that the research in topic focus more on how making comparison between conventional and Islamic performance, how portofolio diversification brought benefit, relative efficiency and the comparison of risk-return profile. The article closed its result by stating that any generalization based on previous research is still can’t be done and thus makes Islamic capital market remains a fertile ground to discover.

Similar conclusion was made by Masih et al.,[24] who compiled dozens of Islamic equities articles. The research concluded that topics discussed in general are comparative performance between both the conventional and Islamic equities and comparison between Socially Responsible Investment and Islamic equities. However, the article noted that there found methodological advancement in the topic, from simple linear regression to the most complex methods. In the end, the result emphasizes that the performance of Islamic equities in general needs more query since the current body of literatures cannot give satisfying answer that can be generalized.

Another study in the topic of Islamic market by investigating previous studies was done by Foglie and Panetta[25] The research in this particular article is more detail and specific in the debate on Islamic stock market vis-à-vis conventional. Still, it resulted same answers as previous two studies above for the inconclusivity of the research. In general, about two-third of the article said the preferability of Islamic stock market over conventional. However, another one-third posed different arguments and proofs, making the conclusion still open for further debate and discussion.

If we investigate another study in the field of Islamic capital market that use literature as the main data, we will find that most of it are partial in specific segment. For example, Miskam et al.,[26] focuses only on shariah governance aspect within Islamic capital market field. The study used only few articles that made the authors in the end of the article to state that further research and examination on shariah governance is necessary to build up more robust standard for Islamic capital market. Another research was done by Uluyol[34] who gathered 213 articles in the topic of sukuk and analyze four main categories of the research in Sukuk topic. The categories include fundamental and structural difference between Sukuk and and conventional bond, empirical research that has been done in sukuk topic, customers’ preference on sukuk and conventional bond, legal and Shariah issues sorrounding sukuk, and lastly about sukuk pricing. The research bought comprehensive results in each of those five categories and followed it with suggestion for further research.

Three researches that tried to grasp a broader scope of Islamic capital market through the investigation of literatures was done by Rizvi and Alam,[35] Hassan[23] and Shafi and Tan.[36] However, the first research focused on differentiating the feature between Islamic and conventional capital market while using content analysis and giving only a bit direction for future research. The second research was more reach and depths in nature since it clearly identifies the previous researches of Islamic capital market and leave one suggestion for future research. However, that research doesn’t use the bibliometrical approach. It is different from the third paper that used bibliometrical approach with the focus on Islamic capital market. Nonetheless, this third paper limits its data to only articles indexed in Web of Science Core Collection although successfully identified significant direction for future research by doing so. This is different from what this article is trying to do where the data was taken from Scopus instead of WOS Core Collection.

As we can see here that major literature analysis in the topic of Islamic capital market is done by using content analysis. Then, from 2019 onwards, we can see there are several researches done by using bibliometric but doesn’t discuss particularly in the field of Islamic capital market.[21,27,28] Here, it can be inferred that there is still huge room for bibliometric research to dive deeper into the topic of Islamic capital market. Therefore, the study here which is conducted using bibliometric clearly will fill that gap and gives significant contribution to the readers. In addition, it gives additional information from what Shafi and Tan has conducted since this paper broadens the data of the article to all papers indexed by Scopus.

METHODOLOGY

To achieve the right results, this research uses bibliometric analysis. This type of analysis is used to observe quantitative investigations of published academic works.[37] In addition, network analysis through bibliometric tools has proven useful in identifying currently developing fields.[38] This bibliometric analysis follows the suggestions of Da Silva and Souza[39] by conducting several steps to scrap the data from any database, followed by cleaning the extracted data to ensure its validity and finally conducting various analysis in order to come up with the result intended for the research (see Table 1 for the detail).

| Step | Description |

|---|---|

| 1 | Data Inclusion. |

| 1.1 | Defining the database. |

| 1.2 | Defining the keywords. |

| 1.3 | Defining the filter as search limitation. |

| 1.4 | Searching for execution. |

| 1.5 | Data extraction of selected documents. |

| 2 | Data cleansing. |

| 2.1 | Checking for any data duplication. |

| 2.2 | Checking for any incorrect data. |

| 3 | Data analysis. |

| 3.1 | Analysis on publication trends. |

| 3.2 | Analysis on key areas of published literatures. |

| 3.3 | Analysis on the most contributing journals. |

| 3.4 | Analysis on the main figure of scholars. |

| 3.5 | Analysis on the main countries and collaborations. |

In collecting the data, we use Scopus database for several reasons. First, Scopus is a database that indexes a larger number of journals than PubMed, Web of Science, and Google Scholar.[40] Second, Scopus database is considered by researchers to be the largest multidisciplinary database of peer-reviewed literature in academia. In addition, Scopus is currently the largest scientific institution with a reputable database, so the quality of publications can be guaranteed.[41] Third, although Google Scholar holds broader range of data,[42] it is lack of scientific validation and unaudited articles of low quality.[43] Next, we determined several keywords combination to capture all aspects of Islamic capital market. Since we want to capture general literature within Islamic capital market topic, we use main keywords of “Islamic” and adding it with topic keywords that are” “Capital Market” OR “Stock” OR “Share” OR “Equity”. Table 2 gives the details of data collection protocol.

| Category | Definition |

|---|---|

| Main keywords | “Islamic” |

| Topic keywords | “Capital Market” OR “Stock” OR “Share” OR “Equity” |

| Database | Scopus |

| Search type | Title, abstract, author keywords |

| Document type filter | Articles and proceedings |

| Language filter | English only |

| Subject area filter | Only search on economics and business field |

| Timespan | From the beginning |

| Date search | 08-Sep-22 |

RESULTS

Table 3 presents the main features of the data used for analysis. There are 1,336 research articles which belong to 317 journal sources. 1000 of the data was in the form or while the rest are conference proceedings. We see that out of 2.421 authors, only 195 authors publish journals as single authors. The annual growth rate discussing Islamic stocks comprises 13.68% of the literature, which is very adequate, and the average citation of each document is relatively high (13.41), indicating increasing academic interest in this field. In addition, we can see high international collaboration which clearly shows that scholars in this field mostly conducted joint research with colleague overseas.

| Description | Result |

|---|---|

| Main information about data | |

| Timespan | 1982-2022 |

| Sources (Journals) | 317 |

| Documents | 1.336 |

| Annual Growth Rate % | 13.68 |

| Document Average Age | 4.62 |

| Average citations per document | 13.41 |

| References | 55782 |

| Document Type | |

| Article | 1.300 |

| Conference Paper | 36 |

| Document Contents | |

| Keyword Plus (ID) | 679 |

| Authors’ keywords (DE) | 3.265 |

| Authors | |

| Authors | 2.421 |

| Authors of single-authored document | 195 |

| Author Collaboration | |

| Single-authored docs | 234 |

| Co-authors per docs | 2.69 |

| International co-authorship % | 31.83 |

As for the next, we will present the results based on the protocol presented at Table 4. The table is the extended detail of what has been described previously at Table 1. There are mainly 5 areas of interest: publication trends, key areas of published literature, most contributing journals, main figure of scholars, countries and collaboration.

| Step | Topic | Analysis Process |

|---|---|---|

| 1.1 | Publication developments | Compiling literatures based on year of publication and plot it into a time-graph. |

| 1.2 | Publication developments | Grouping articles into several times span and categorize it based on research area. |

| 2.1 | Key areas of published literatures | Mapping the interconnection of literatures based on keyword co-occurrence. |

| 2.2 | Key areas of published literatures | Counting the number of keywords appears in the articles and measuring its link’s strength. |

| 2.3 | Key areas of published literatures | Visualizing the keyword trends based on year of publication under keyword’s co-occurrence analysis. |

| 3 | Most contributing journals | Filtering the journals based on number of published articles in related topics. |

| 4.1 | Main figure of scholars | Measuring the most cited article written by authors, including the venue of that article’s publication. |

| 4.2 | Main figure of scholars | Measuring the most cited article written by authors, including the venue of that article’s publication. |

| 4.3 | Main figure of scholars | Measuring the most contributing institution based on scholars’ affiliation. |

| 5.1 | Countries and collaboration | Mapping and visualizing the co-authorship by authors among countries. |

| 5.2 | Countries and collaboration | Visualizing how the collaboration among countries occurred throughout the years. |

Publication Developments

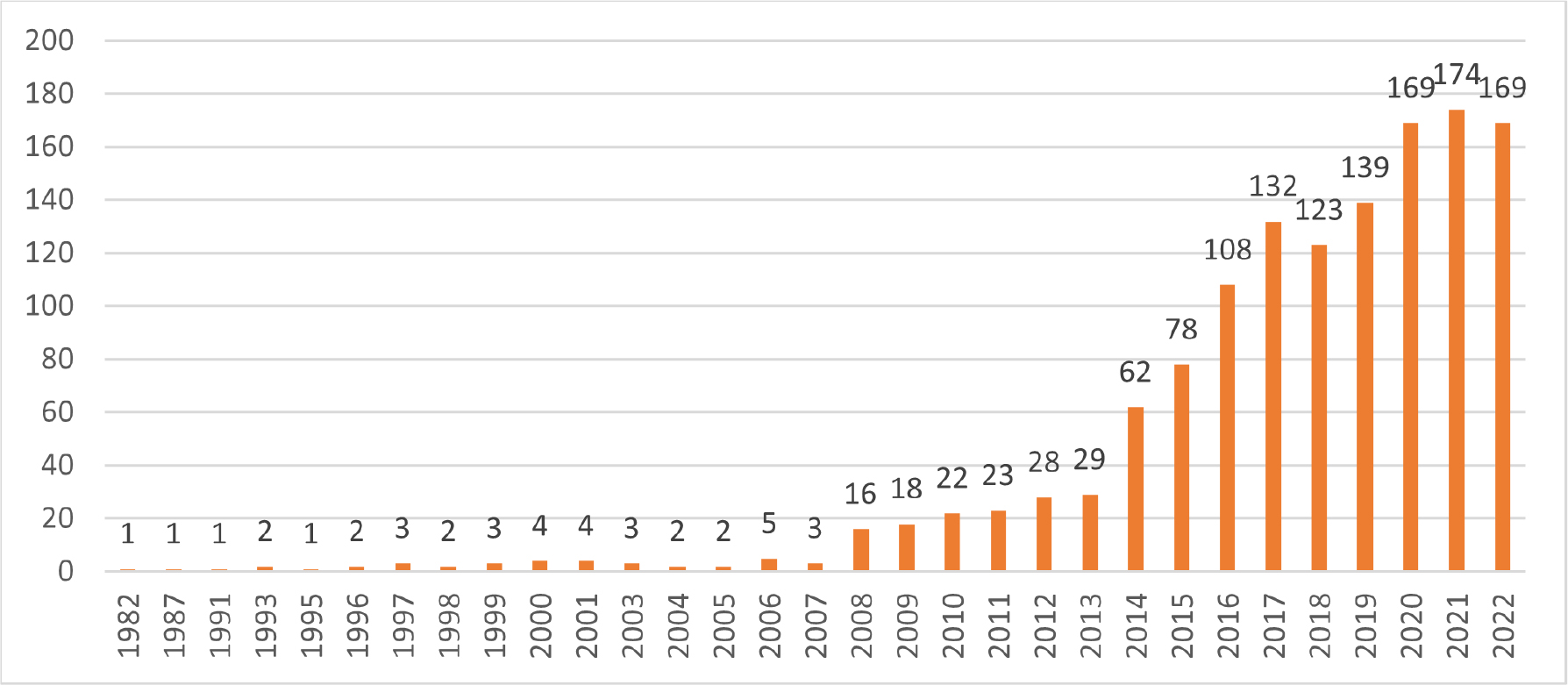

Figure 1 shows the development of Islamic capital market topic based on the amount of literature collections published from 1982 to 2022. The earliest article found to be indexed under Scopus was in 1982. The result is interesting since as we know, Islamic finance industry was not a well-developed industry during that year. The first Islamic bank in the industry according to some scholars was at 1975 marked by the establishment of Dubai Islamic Bank.[44] It means, it only takes 7 years until researchers began to talk about Islamic capital market. However, intellectual development in this field was stagnant until 20 years later. Only in 2008 was there found a surge of research in the area. The reason was the financial crisis that severely hit the economics and financial institutions triggered researchers’ interest to conduct deeper analysis in the topic. Then, from 2013 onwards, the research experienced steady growth trend before finally peaking in the total of 174 documents yearly.

Figure 1:

Growth of Islamic capital market literature.

Taking a deeper look on the publication developments, we classified it into four timespan as can be seen at Table 5. The first is publication of Islamic capital market in its early development, ranging from 1982 to 2007 that we noted the discussion in that period revolved around the fundamental and basics of Islamic capital market. For example, Choudhury[44] wrote article on how Islamic capital market follows the worldview of Divine Unity. Another article, still focusing on how Islamic religion is incorporated within Islamic capital market, was done by Naughton and Naughton[45] who discussed in length about the foundation and boundaries of Islamic capital market according to Islamic teaching. Similar thing was done by Smolarski et al.,[46] who tried to investigate the Islamic requirement on the hedging activities using instruments provided in the capital market.

| Period | Topic of Discussion |

|---|---|

| 1998-2007 | Fundamental of Islamic capital market. |

| 2008-2013 | Development of Islamic capital market. |

| Islamic capital market during global crisis. | |

| 2014-2019 | Islamic vis-à-vis conventional capital market. |

| 2020-2022 | Islamic capital market during COVID-19 pandemic. |

The research on 2008-2013 shows two types of directions. First is the continuing development of Islamic capital market, shown by research from Jobst et al.[47] who started discuss about sukuk and sovereign debt managers, Selim[48] who laid a theory on asset pricing model for Islamic capital market, as well as Yusof and Majid[49] who discussed the possibility of Malaysia to be Islamic international financial hub through the development of Islamic capital market. However, many other researchers talked about the on-going and aftermath of financial crisis back on those years. Abdul Aziz[50] directly took initiative to discuss the effect of several Islamic debt instruments by reflecting to 2008 financial crisis. Another initiative was taken by Kassim,[51] Karim et al.,[52] Bin Mohd.[53] All these three researchers investigated the financial contagion in the realm of integrated capital market between Islamic and conventional.

As for the next 5 years, we found researchers inclination in the topic was towards the performance of Islamic capital market which in many cases are directed specifically to make comparison between Islamic and its counterpart. Starting from Ho et al.,[54] and Dewandaru et al.,[55] who clearly investigated the comparative performance of Islamic and conventional indices, Al-Khazali et al.,[56] who investigated market efficiency of both Islamic and conventional indices, Ahmed[57] who tried to look further about political risk in both equity markets, as well as Rejeb and Arfaoui[58] who also tried to write about whether Islamic indices could really outperform its counterpart.

The trend of the research then shifted towards health and financial crisis in the year 2020 until 2022. This is due to the COVID-19 pandemic that hit every sector in all countries around the world. Therefore, it is not surprising to find a research that clearly state COVID-19 effect in its title such as the article from Sherif[59] and Naeem et al.,[60] Hassan et al.,[61] Another research was also focused on what is the save haven during the pandemic, either by investigating Islamic capital market on itself[62] or by comparing it into another option of save haven, including bitcoin and golds.[63]

Key Areas of Published Literatures

Publications in Islamic capital market area that started in 1982 generated 3.265 keywords from 1336 documents. We found that the keywords in Islamic capital market topic has very high variation to the extent that some keywords has slight difference. For example, we can find keyword “investment” and investments” with only has letter -s- as additional difference, or “islamic index” and “islamic indices” which refers to the same meaning, or “financial crisis” and “global financial crisis” that in several cases has no substantial difference. Table 6 provides a detail of number keywords occurred within all documents that appeared the most while trimming all redundant keywords.

| Keyword | n | Link Strength | Keyword | n | Link Strength | Keyword | n | Link Strength | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Islamic finance | 186 | 333 | Investment | 34 | 176 | Gold | 20 | 121 | ||

| Islamic banks | 120 | 256 | Profitability | 30 | 81 | Finance | 20 | 97 | ||

| Stock market | 58 | 367 | Performance | 29 | 66 | Volatility | 20 | 52 | ||

| COVID-19 | 56 | 197 | Corporate governance | 28 | 61 | Pakistan | 20 | 46 | ||

| Malaysia | 55 | 117 | Commerce | 27 | 235 | Emerging markets | 19 | 57 | ||

| Sukuk | 54 | 130 | Capital structure | 27 | 62 | Financial performance | 19 | 38 | ||

| Islam | 53 | 124 | Capital market | 24 | 84 | GCC | 18 | 55 | ||

| Financial crisis | 47 | 167 | Indonesia | 24 | 63 | Economic growth | 18 | 44 | ||

| Islamic stock | 37 | 97 | Saudi arabia | 23 | 77 | Oil price | 17 | 127 | ||

| financial market | 35 | 282 | Islamic capital market | 21 | 33 | Risk management | 17 | 99 |

As we can see at Table 6, Islamic finance and Islamic banks both occurred the most in the documents that has been published. While it seems a bit odds to find both keywords as the dominant, the detail is different. For example, the keyword Islamic finance becomes the most dominant because there is strong relationship in the discussion of Islamic capital market and Islamic finance. In addition, both are interrelated and in some cases are inseparable. For instance, the writing of Kok et al.,[64] and Abumustafa and Al-Abduljader[65] both investigated the islamic indices and derivative securities diversification in its relation with Islamic finance in general. Another research was done by Issoufou and Oseni[66] and Muhamad Sori et al.,[67] discussed about sukuk and its correlation with Islamic finance industry. As for the Islamic banks word, we found similar results. Ebrahim, and Rahman,[68] Baydoun and Anwar[69] both talked about future contracts and sukuk market while referring to the benefit of Islamic banks. Meanwhile, Al-Ali and Yousfi[70] Ng et al.,[71] Hussain et al.,[72] all discussed Islamic finance and banking in general, including the theory and practice of Islamic capital market.

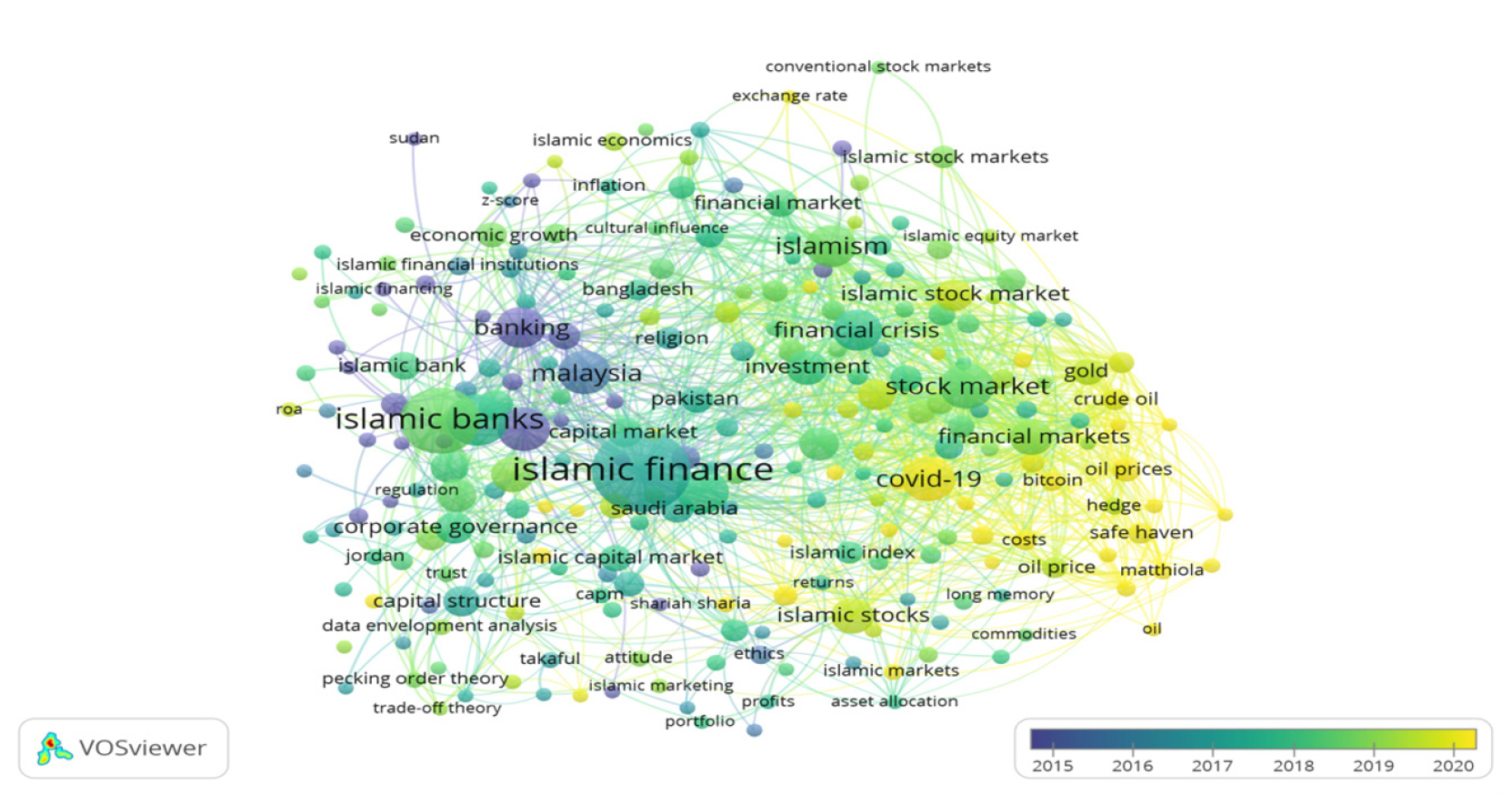

In biblioemtric, we also analys the linkage among keywords to see how the keywords are interrelated each other. Figure 2 shows the visualization of keywords co-occurrence where each circle shows a keywords while its size indicates its relevance. Any line drawn there is a linkage between keywords where the distance shows the strength of the linkage. The visualization also provides colors that denote how these keywords are clustered each others.

Figure 2:

Keyword co-occurrence network on Islamic Capital Market.

There are seven clusters in total where Islamic finance stands as the central linkage of other keywords. The clusters are Islamic finance in general, risk, profit-loss sharing model, governance, investment and profits, sukuk, and lastly is about crisis. As we can also see there that several countries are mentioned such as, Malaysia, Bangladesh, Jordan, Sudan and Pakistan which indicate a deeper study in those countries.

In addition to that, we also provide how these key areas evolved throughout the years as we can see at Figure 3. The purple color indicates that the area of research is already old and thus shifting gradually to the yellow color. As we can see, some nodes with purple colors are Malasyia, Islamic banks, and the keyword capital market itself. The current trend of the research however moves toward comparing Islamic capital market instruments to commodities, such as gold, crude oil, and even bitcoin. This new trend was brought due to COVID-19 that demands investor to seek a save haven for their assets. This is clear enough because the node COVID-19 has a clear yellow color with the biggest node compared to other yellow circle.

Figure 3:

Keyword co-occurrence network on Islamic capital market over the years.

Most Contributing Journals

In Table 7 we try to capture the most 20 contributing journals towards the topic. In the other word, these journals are the best venue so far to publish articles related to the Islamic capital market area. As we can see, two well-known publishers contributed the most, they are Emerald Group Publishing and Elsevier. Each of these two publishers has 6 journals that put high concern regarding Islamic finance industry. Meanwhile, Taylor and Francis contributed as much as two journals which are Applied Economics and Emerging Markets Finance and Trade. Apart of these famous publishers, there are three university publishers, from Saudi Arabia, Turkey and Malaysia. From these three, Borsa Istanbul Review is already known as journal that put high attention on the research of economics and finance, while Journal of King Abdulaziz University Islamic Economics is a famous journal among Islamic finance researchers to publish their article.

| Rank | Sources | Article | H Index | Quartile | SJR | Publisher |

|---|---|---|---|---|---|---|

| 1 | International Journal of Islamic and Middle Eastern Finance and Management. | 103 | 28 | Q1 | 0.501 | Emerald |

| 2 | Journal of Islamic Accounting and Business Research. | 75 | 17 | Q2 | 0.359 | Emerald |

| 3 | Pacific Basin Finance Journal. | 66 | 44 | Q1 | 0.824 | Elsevier |

| 4 | Journal of Islamic Marketing. | 36 | 16 | Q2 | 0.551 | Emerald |

| 5 | Borsa Istanbul Review. | 28 | 23 | Q1 | 0.709 | Borsa Istanbul Anonim Sirketi |

| 6 | Journal of King Abdulaziz University Islamic Economics. | 27 | 4 | Q3 | 0,155 | King Abdulaziz University Scientific Publishing Center |

| 7 | Isra International Journal of Islamic Finance. | 24 | 6 | Q2 | 0,372 | Emerald |

| 8 | Applied Economics. | 22 | 8 | Q2 | 0.563 | Taylor and Francis |

| 9 | Research In International Business and Finance. | 20 | 19 | Q1 | 1.043 | Elsevier |

| 10 | Journal of International Financial Markets Institutions and Money. | 19 | 18 | Q1 | 1.310 | Elsevier |

| 11 | Emerging Markets Finance and Trade. | 18 | 17 | Q1 | 0.960 | Taylor and Francis |

| 12 | Journal of Asian Finance Economics and Business. | 17 | 5 | — | — | Korea Distribution Science Association (KODISA) |

| 13 | Managerial Finance. | 17 | 9 | Q2 | 0.423 | Emerald |

| 14 | Quarterly Review of Economics and Finance. | 17 | 15 | Q2 | 0.687 | Elsevier |

| 15 | Humanomics. | 16 | 13 | Q2 | 0.210 | Emerald |

| 16 | International Journal of Emerging Markets. | 16 | 6 | Q2 | 0.508 | Emerald |

| 17 | Resources Policy. | 15 | 8 | Q1 | 1.461 | Elsevier |

| 18 | Banks And Bank Systems. | 14 | 6 | Q1 | 0.187 | Business Perspectives |

| 19 | International Journal of Business and Society. | 13 | 3 | Q3 | 0.237 | Universiti Malaysia Sarawak |

| 20 | Journal of Economic Behavior and Organization. | 13 | 11 | Q2 | 1.107 | Elsevier |

As we also can see, International Journal of Islamic and Middle Eastern Finance and Management ranked first. This is not surprising since the journal is already famous for its effort in publishing articles related to Islamic finance and management with an average of 60 documents yearly in the last three years. This leading journal is followed by Journal of Islamic Accounting and Business Research, another famous venue of publication for Islamic finance researchers. The scope of this journal clearly stated that accounting and business knowledge based on Islamic teachings will be its core objective where many branches of study within Islamic finance is also covered, such as Islamic philantrophy, Islamic jurisprudence on product innovation, financial and non-financial performances of Islamic business organizations, and many others. Lastly, ranked third in the table is Pacific Basin Finance Journal, a well-known journal in the field of economics and finance in general. However, if we see deeper to this journal, we can easily find a lot of articles under Islamic finance area.

It is also important to note that among these top 20 journals, 8 of them are Q1 journals. It means that its credibility is acknowledged and each of the journals has very high impact in knowledge and research development. Meanwhile, we found 9 of these journals are categorized as Q2 which strongly support our finding regarding the high impact of the most contributing journals. Also, as we can see, we found no Q4 journals within the list which implies the robustness of this finding in the context of best venue for publishing Islamic capital market related articles.

The most interesting part to take note is that one of these journals is discontinued to be indexed in Scopus, that is Journal of Asian Finance Economics and Business. The official release from Scopus is that the journal is discontinued due to publication concerns with the last coverage in 2021 volume 8 issue 4. The concern flagged by communities could be also due to its unnatural surge of its quartile from 2019 to 2020 or its unexplainable changes to number of articles published.

Main Figure of Scholars

First, we present the main figure of scholars based on their most cited document. This analysis is important to show the influence of a scholar based on a single document. As we can see at Table 8, Aggarwal[73] produced a document that gained citation of 229, the highest among other authors. This number was followed by Hayat and Kraeussl[74] with the citation counting to 178 citations. It is undeniable that both documents laid fundamental characteristic of Islamic capital market and thus made significant impact towards the topic.

| Authors | Title | Year | Source Title | Cited by | TC per Year |

|---|---|---|---|---|---|

| Aggarwal R.K. | Islamic Banks and Investment Financing. | 2000 | Journal of Money, Credit and Banking. | 229 | 9.96 |

| Hayat R., Kraeussl R. | Risk and Return Characteristics of Islamic Equity Funds. | 2011 | Emerging Markets Review. | 178 | 14.83 |

| Ho C.S.F., Abd Rahman N.A., Yusuf N.H.M., Zamzamin Z. | Performance of Global Islamic Versus Conventional Share Indices: International Evidence. | 2014 | Pasific Basin Finance. | 167 | 18.56 |

| Al-Khazali O., Lean H.H., Samet A. | Do Islamic stock indexes outperform conventional stock indexes? A stochastic dominance approach. | 2014 | Pasific Basin Finance. | 160 | 17.78 |

| Abdullah F., Hassan T., Mohamad S. | Investigation of performance of Malaysian Islamic unit trust funds: Comparison with conventional unit trust funds. | 2007 | Managerial Finance. | 158 | 9.88 |

| Hoepner A.G.F., Rammal H.G., Rezec M. | Islamic Mutual Funds’ Financial Perfomance and International Investment style: Evidence form 20 Countries. | 2011 | European Journal of Finance. | 153 | 12.75 |

| Derigs U., Marzban S. | Review and Analysis of Current Shariah-Compliant Equity Screening Practices. | 2008 | International Journal of Islamic and Middle Eastern Finance and Management. | 149 | 9.93 |

| Ajmi A.N., Hammoudeh S., Nguyen D.K., Sarafrazi S. | How Strong are the Causal Relationships between Islamic Stock Markets and Conventional Financial Systems? Evidence from linier and nonlinier tests. | 2014 | Journal of International Financial Markets, Institutions and Money. | 147 | 16.33 |

| Jawadi F., Jawadi N., Louhichi W. | Conventional and Islamic Stock Price Performance: An Empirical Investigation. | 2014 | International Economics. | 140 | 15.56 |

| Hammoudeh S., Mensi W., Reboredo J.C., Nguyen D.K. | Dynamic Dependence of the Global Islamic Equity Index with Global Conventional Equity Market Indices and Risk Factors. | 2014 | Pasific Basin Finance Journal. | 136 | 15.11 |

| Godlewski C.J., Turk-Ariss R., Weill L. | Sukuk vs Conventional Bonds: A Stock Market Prospective. | 2013 | Journal of Comparative Economics. | 121 | 12.10 |

| Majdoub J., Mansour W. | Islamic Equity Market Integration and Volatility Spillover Between Emerging and US Stock Market. | 2014 | North American Journal of Economics Finance. | 109 | 12.11 |

However, it is important to note that both documents are old and have been read for 22 years and 11 years respectively. Therefore, we need to identify the main figure of scholars from different perspectives, that is by counting total citation per year. The article written by Ho et al.,[54] was found to be the highest cited article yearly, reaching up to 18,56 citations and followed by Al-Khazali et al.,[75] who gained 17,78 citations yearly. Interestingly, both articles are published by Pacific Basin Finance Journal which is in line with our findings presented at Table stating that this journal made significant contribution to the topic of Islamic capital market.

Apart from the result above, we also find that the most influencing document written was the one that discussed comparison between Islamic and conventional capital market. This indicates that researchers are curious on how is the performance of Islamic capital market, whether it follows the theory that Islamic capital market should outperform its counterpart, or could the reality say otherwise? Therefore, any other future research should consider a comparative perspective if they want the article to gain greater impact.

Since we understand the most influencing figure based on a single document, now we analyse on the most influential figure based on number of articles. Table 9 provides the details of the analysis. It is interesting that the authors come from various countries and continent while usually the interest on Islamic finance industry comes from major Moslem countries. As we can see, the most influencing scholar with highest citation of 1074 is Shawkat M. Hammoudeh from United Stated followed at the second rank was Abu Mansur M. Masih with total citation of 760 while Walid Mensi from Vietnam ranked third. Total citations from the first ranking to the 3rd showed a big difference in numbers. However, from third ranking onwards, there was only a little difference.

| Author Name | Affiliation | Country | No. of Articles | Citations |

|---|---|---|---|---|

| Shawkat M. Hammoudeh | LeBow College of Business. | United Stated | 22 | 1074 |

| Abu Mansur M. Masih | International Centre for Education in Islamic Finance. | Malaysia | 24 | 760 |

| Walid Mensi | University of Economics Ho Chi Minh City. | Vietnam | 13 | 542 |

| Mohammad Kabir Hassan | University of New Orleans. | United Stated | 32 | 509 |

| Paresh Kumar Narayan | Monash Business School. | Australia | 13 | 365 |

| Syed Aun R. Rizvi | Lahore University of Management Sciences. | Pakistan | 11 | 345 |

| Obiyathulla Ismath Bacha | International Centre for Education in Islamic Finance. | Malaysia | 10 | 338 |

| Nader Naifar | University of Sfax. | Tunisia | 15 | 332 |

| Ginanjar Dewandaru | Indonesia National Committee of Islamic Economy and Finance. | Indonesia | 7 | 300 |

| Burhan Uluyol | Istanbul Sabahattin Zaim University. | Turkey | 12 | 296 |

| Fredj Jawadi | Universite de Lille. | France | 12 | 282 |

| Nabila Jawadi | IPAG Business School. | France | 12 | 282 |

| Syed Jawad Hussain Shahzad | Montpellier Business School. | France | 10 | 277 |

| Chaker Aloui | Prince Sultan University. | Saudi Arabia | 9 | 273 |

| Ahmet Sensoy | Bilkent Universitesi. | Turkey | 7 | 268 |

| Dawood Ashraf | Islamic Research and Training Institute. | Saudi Arabia | 9 | 263 |

| Nafis Alam | Monash University Malaysia. | Malaysia | 6 | 260 |

| Rangan Gupta | University of Pretoria. | South Africa | 8 | 223 |

| Dinh Hoang Bach Phan | La Trobe University. | Australia | 7 | 215 |

| Ahdi Noomen Ajmi | Prince Sattam Bin Abdulaziz University. | Saudi Arabia | 5 | 211 |

This result can be seen from different angles by looking at the total number of documents. In that context, we found Mohammad Kabir Hassan as the author with the highest number of articles, reaching 32 documents. It makes Mohammad Kabir Hassan to be the most influential figure in Islamic economics and finance research in general. In addition, the total document in the topic of Islamic capital market is far from the second ranked author, Abu Mansur M. Masih, who wrote only 24 documents. The third rank onwards has only slightly different in total number of articles.

Lastly, to understand the most influential figures in Islamic capital market topic, we conducted analysis of author’s affiliation. Table 10 provided the details. Here, Malaysia dominated the research summing up to 326 out of total 1136 documents. It means roughly one-fourth of the researches come from Malaysia which makes this country unshakable hub for the research in the field of Islamic economics and finance.[76,77] While it seems that International Centre for Education in Islamic Finance (INCEIF) ranked the highest, International Islamic University Malaysia (IIUM) actually had highest number of document once we add the Institute of Islamic Banking and Finance as part of IIUM, summing up to total 105 documents or almost 10% of the researches came from single university in Malaysia.

| Rank | Affiliations | Country | Articles |

|---|---|---|---|

| 1 | International Centre for Education in Islamic Finance. | Malaysia | 87 |

| 2 | International Islamic University Malaysia. | Malaysia | 71 |

| 3 | Universiti Teknologi MARA. | Malaysia | 42 |

| 4 | University of New Orleans. | USA | 41 |

| 5 | International Islamic University Malaysia, Institute of Islamic Banking and Finance. | Malaysia | 34 |

| 6 | Al-Imam Muhammad Ibn Saud Islamic University. | Saudi Arabia | 32 |

| 7 | Universiti Kebangsaan Malaysia. | Malaysia | 31 |

| 8 | Universiti Malaya. | Malaysia | 31 |

| 9 | Universiti Utara Malaysia. | Malaysia | 30 |

| 10 | University of Sfax. | Tunisia | 29 |

| 11 | Drexel University. | USA | 23 |

| 12 | Lahore University of Management Sciences. | Pakistan | 23 |

| 13 | Université de Tunis El Manar. | Tunisia | 23 |

| 14 | Universitas Indonesia. | Indonesia | 21 |

| 15 | LeBow College of Business. | USA | 19 |

| 16 | Université de Tunis El Manar, Faculté des Sciences Economiques et de Gestion de Tunis. | Tunisia | 18 |

| 17 | Montpellier Business School. | France | 18 |

| 18 | Université de Tunis. | Tunisia | 17 |

| 19 | Suleman Dawood School of Business. | Pakistan | 17 |

| 20 | King Abdulaziz University. | Saudi Arabia | 16 |

While Malaysia becomes the leading countries where scholars reside there, we cannot ignore the contribution of another affiliation from various countries. First of all, United States of America had three universities that can be referred for research in Islamic capital market topic. Particularly, University of New Orleans is where Mohammad Kabir Hassan, the most productive scholar, is affiliated. As for Saudi Arabia, it is interesting to know that King Abdulaziz University which is known as having high concern on Islamic economics and finance ranked the lowest among 20 affiliations. It is also important to note that Pakistan had two affiliations written in the table, while it refers to one same university. The same goes to Tunisia, particularly Université de Tunis El Manar that was written to have Faculté des Sciences Economiques et de Gestion de Tunis as separate affiliation. As for Indonesia, it is interesting that the country with tens of universities teaching Islamic economics and finance yet appeared to be having the lowest publications among 20 affiliations.

Collaboration and Countries

Collaboration in research is common practice. In fact, collaborating in a conducting a research means that scholars in countries involved are well-versed in the topic which could also indicate the topic’s popularity among countries. In addition, a collaboration in a research and author diversity adds to the rigorousness of a research since the authors put their different mind into one scientific text that correct or advice each others opinion.

Figure 4 shows the visualization of countries’ collaboration with five obvious clusters: red, green, blue, yellow and purple. Malaysia stood out to be the biggest node compared to others. It is totally not suprising since Malaysia so far is considered as one of the most important countries in developing Islamic economics and finance. This result is also in line with all previous findings that many scholars and afiiliation contributing to the Islamic capital market research topic came from Malaysia. This country also collaborated with all clusters, making it a hub and reference for collaboration. Another important note is that Malaysia is clustered under red color and collaborated mostly with Indonesia and Pakistan.

Figure 4:

Global collaboration network on Islamic capital market.

In addition, we also analys this collaboration based on time frame as shown in Figure 5. It provides additional note that collaboration with Malaysia has occured since long time ago. In fact, almost all collaborations are found to be happened from years ago while the new collaboration, indicated with yellow colour, is rare. The new collaboration only includes China, Qatar and Pakistan to some extend. Surprisingly, countries with recent collaboration and those with small nodes in the figure has low contribution towards Islamic capital market topic as it can be seen in the discussion of most influence figure. It implies that collaboration ensures readibility and the impact of any article.

Figure 5:

Global collaboration network on Islamic capital market over the years.

We also count the document of collaboraion written by countries with the result provided at Table 11. Malaysia made very high number of collaboration and with as high as 33 countries that include even a country with low publication in Islamic econcomics and finance in general, such as Poland, New Zealand, Ireland, China, Denmark and many others. Interestingly, we can count at table that only several countries with predominantly Muslim population made collaboration with more than 10 other countries.

| Country | Link | Total link strength | Collaboration Document | Collaborating countries |

|---|---|---|---|---|

| Malaysia | 34 | 220 | 213 | 33 |

| United States | 31 | 178 | 179 | 23 |

| Saudi Arabia | 27 | 146 | 142 | 26 |

| Pakistan | 27 | 143 | 136 | 29 |

| France | 26 | 131 | 128 | 19 |

| United Kingdom | 28 | 122 | 120 | 19 |

| Australia | 20 | 78 | 77 | 20 |

| Indonesia | 12 | 36 | 38 | 13 |

| Bangladesh | 28 | 38 | 36 | 8 |

| India | 19 | 30 | 24 | 11 |

| Oman | 18 | 40 | 20 | 30 |

Implication of The Study

The elaborated data above brings us towards important notes that can amplify the study in the field of Islamic capital market. Since one of the most important aspects is the key areas of published literature posed as research question number two, our discussion will first start from it. Based on the findings of research question number two, it was found that there are seven clusters of the ongoing research within Islamic capital market field. These seven clusters lead towards three key highlights. First, there is a highly packed area of research yet the interest there is still growing and any further research under the same nuance is still possible. The area is about the comparison between Islamic and conventional capital market. The reason why there is still room for improvement in future research is due to the complexity of this field of research. Comparison between both types of systems encompass many aspects. It has the possibility to compare the functionality of both markets as safe haven, the performance of each during turbulence, the volatility and fluctuation, the expected financial benefit, the asset pricing effect and many others.[78–85] This suggestion is also in line with the findings from research question number one where there was period researches focused mainly on the comparison between both markets.

Second, there is an area that doesn’t develop overtime and there is no much dynamic discussion within it, that is about sharia stock screening methodology. The critics and urgency of redeveloping the method had been brought by Bin Mahfouz and Ahmed.[86] The paper they presented was so detail, discussing nine aspects of the methodology, starting from the credibility, inconsistency, sudden change of the rules, financial ratios, earning purification process, the divisor of the threshold, social responsibility and lastly the shariah supervision. Four years later, a research paper in the form of literature compilation and content analysis by Masih et al.,[24] also pinpointed the area that needs more attention and consideration, one of which is this stock screening methodology. However, the discussion for developing the methodology is rare, and almost too difficult to find as it can be seen from the findings of this article from research question number two where the main keywords occurrence doesn’t mention about screening methodology. The screening methodology is fundamental, on which all the research in the topic of Islamic capital market is built. For example, research discussing volatility issues within Islamic capital market can only use the stock that has passed the screening. If the screening methodology itself needs to be improved, then the research result of that issue will be biased.

Third, there are undiscovered parts of the emerging topics in this digitalized era. For instance, the unfolding phenomenon of digital industry and society must have its impact on Islamic capital market. The blockchain technology in particular has powerful potential to be embedded within the market. This lack of development has also been pinpointed by Shafi and Tan[36] who emphasized that digital finance should also be incorporated in Islamic capital market. Scopus database also only recorded six documents with the keywords “blockchain AND Islamic AND capital AND market” which strengthen the results and implication of this study.

Apart from three points above, several findings also implied other important aspects which are summarized in the following things:

Country coverage is still rare. The main keywords shows that most study are cross country analysis. It implies that either the in-depth study of certain countries has no importance and great significance since no big picture can be drawn from it, or the data is not available in that country.

Needs for collaboration. The findings show that most studies are conducted in collaboration by several authors. It implies that the study in capital market is complex and thus necessitates a cross-country collaboration. As it also has mentioned previously, collaboration also ensures paper readibility from wider readers.

Specific venue of publication. The findings also implies that the acceptance of publishing article within the scope of Islamic capital market is also high in a reputable journals of Scopus Q1 and Q2. Authors should seize the opportunity of publishing their works in such journals where readability and citedness is also higher.

Diversity of experts. Unlike other sub-field of Islamic finance where there are authors whose work can be followed thoroughly to obtain better understanding of that field, the result of this research implies that a scholar have no choice but to follow several scholars at once. This is because no outstanding scholar can be identified since their achievements are comparable to one from another.

CONCLUSION

Studies and literatures in Islamic capital market is enormous. Thus, this research aimed to capture those articles and make intellectual map based on those published researches. In order to achieve the result, we use bibliometric approach by utilizing Scopus as the database extraction. A total of 1336 documents which only include journal and conference proceeding in English language within economics and business category were succesfully extracted and processed for the analysis.

The first publication of Islamic capital market indexed by Scopus was found on 1982. The number of publications was stagnant until 2007 and then a surge steep upward trend occurred until 2022 September which was the last date of data extraction. The topic discussion can be classified into 4 periods of research trend: fundamental, development and crisis, comparative and lastly Islamic capital market during pandemic COVID-19. As for the key areas, Islamic finance and Islamic banks found to be the most appeared keywords while capital market keyword came next. This is because numerous research linked the discussion of Islamic capital market with Islamic finance and Islamic banks in general. The keywords found to be clustered into 7 areas: Islamic finance in general, risk, profit-loss sharing model, governance, investment and profits, sukuk, and lastly is about crisis. The most recent key area is COVID-19 and what are the possible instruments to hedge against the economic turmoil during pandemic.

Most contributing journals in the topic are from Emerald and Elsevier publishers with a noticeable three university publishers. Most of these journals have high impact and gained recognition of high quartile in Scopus. As for the most influential scholar based on a single document, there are Rajesh K. Aggarwal followed by Hayat and Kraussel. Besides, the scholar who gained most citations was Shawkat M. Hammoudeh from LeBow College of Business, USA, while scholar with highest number of documents was M. Kabir Hassan from University of New Orleans, USA. In addition, most scholars who contributed to the area of Islamic capital market came from Malaysia, summing up to one-fourth of total documents published worldwide. International Islamic University Malaysia particularly recorded the highest number of documents, roughly about 10% of total published articles. The same result was found for countries collaboration analysis where, again, Malaysia has the highest collaboration documents by collaborating with 33 countries.

This paper contributes to existing literature by providing several factors. First, it closes literatures gap on how the intellectual structure within the area of Islamic capital market has formed and developed. Second, researchers can find several important information that can be used as the basis for future research. This includes the direction on what topic would pose great novelty based on the research trend and key areas in recent years, the guidance on what journals most likely will accept articles within the scope of Islamic capital market, recommendations on who are the most influencial figures to follow and read his/her article regarding the topic, suggestions on countries that is best to stay and reside in order to develop the knowledge and research better, and lastly the clue on scholars of what countries that open their hands for collaboration. In addition, this paper also identified three keyhighlights of future research direction as well as four important points of further discussion based on the findings of the study.

However, this paper also acknowledge that the results obtained are limited since it tried to gather data only from Scopus while there is other major indexing machine that might contain greater number of research in the area of Islamic capital market. We believe collecting data from other various indexing machines will also provide better understanding toward the topic of interest, although Scopus already collected the most possible important research out there.

Cite this article:

Athief FHN, Izzah LN, Rizki D, El-Ashfahany A. Intellectual Structure of Islamic Capital Market Studies: A Bibliometric Approach. J Scientometric Res. 2025;14(1):239-54.

ABBREVIATIONS

| INCEIF | International Centre for Education in Islamic Finance |

|---|---|

| IIUM | International Islamic University Malaysia |

| UAE | United Arab Emirates |

| GCC | Gulf Cooperation Council |

| WOS | Web of Science |

| SJR | SCImago Journal Rank |

| Q1/Q2/Q3/Q4 | Quartile Rankings |

| COVID-19 | Coronavirus Disease 2019 |

| USA | United States of America |

| ICM | Islamic Capital Market |

| ID | Identifier |

| DE | Descriptive Entry |

| TC | Total Citations |

| SJ | SCImago Journal |

| KODISA | Korea Distribution Science Association |

| ISRA | International Shariah Research Academy |

| IPAG | Institut de Préparation à l’Administration et à la Gestion |

| LeBow | LeBow College of Business. |

References

- Tabash MI, Dhankar RS.. The flow of Islamic finance and economic growth: an empirical evidence of Middle East. J Financ Acc.. 2014;2(1):11-9. [Google Scholar]

- Tabash MI, Dhankar RS.. Islamic financial development and economic growth-empirical evidence from United Arab Emirates. J Emerg Econ Islam Res.. 2014;2(3):15 [CrossRef] | [Google Scholar]

- Kassim S.. Islamic finance and economic growth: the Malaysian experience. Glob Finan J.. 2016;30:66-76. [CrossRef] | [Google Scholar]

- Sari N, Widiyanti M.. The impact of Islamic capital market development on economic growth: the case of Indonesia. J Smart Econ Growth.. 2018;3(2):21-30. [CrossRef] | [Google Scholar]

- xAntonio MS, Hafidhoh Fauzi H.. The Islamic capital market volatility: A comparative study between in Indonesia and. Bol Monet Econ Bank.. 2013;15(4) [CrossRef] | [Google Scholar]

- Farid S, Mohsan T, Jan MW.. Do Islamic Stocks reinforce Real Economic Activity? Evidence from an emerging Islamic capital market. Iran Econ Rev.. 2022;26(2):421-33. [CrossRef] | [Google Scholar]

- Hossain MS, Uddin MH, Kabir SH.. Sukuk as a financial asset: a review. Acad Acc Financ Stud J.. 2018;22(Special Issue) [CrossRef] | [Google Scholar]

- Tiby E.. Islamic banking: how to manage risk and improve profitability.. 2011:71-9. [CrossRef] | [Google Scholar]

- Tatiana N, Igor K, Liliya S.. Principles and instruments of Islamic Financial Institutions. Procedia Economics and Finance.. 2015;24:479-84. [CrossRef] | [Google Scholar]

- Usmani MT.. Principles of Shariah governing Islamic investment funds. Islam Mutual Funds Faith-Based Funds Soc Respons Context. 2007:1-9. [CrossRef] | [Google Scholar]

- Kasim N, Htay SN, Salman SA.. Shariah governance for Islamic capital market: A step forward. Int J Educ Res.. 2013;1(6):1-14. [CrossRef] | [Google Scholar]

- Athief FH, Ma’ruf A.. Tracing the asymmetry of religiosity-based loyalty of Islamic bank depositors. Banks Bank Syst.. 2023;18(1) [CrossRef] | [Google Scholar]

- Dawami Q.. Factors influencing the preference of customers towards Islamic banking: evidence from Malaysia. J Islam Econ Laws.. 2020;3(1):48-67. [CrossRef] | [Google Scholar]

- Soemitra A.. Higher objectives of Islamic investment products: Islamizing Indonesian capital market. Stud Islam.. 2016;23(2):237-69. [CrossRef] | [Google Scholar]

- ALI SS. Islamic Capital Markets: products, regulation and development. Islamic Res Train Inst.. 2008:19-34. [CrossRef] | [Google Scholar]

- Hasnie SS, Collazzo P, Hassan MK.. Risk assessment of equity-based conventional and Islamic stock portfolios. Q Rev Econ Finan.. 2022;85:363-78. [CrossRef] | [Google Scholar]

- Tan YL, Mohamad Shafi R.. Capital market and economic growth in Malaysia: the role of ṣukūk and other sub-components. Isra Int J Islam Financ.. 2021;13(1):102-17. [CrossRef] | [Google Scholar]

- Abdullah F, Hassan T, Mohamad S.. Investigation of performance of Malaysian Islamic unit trust funds: comparison with conventional unit trust funds. Manag Finan.. 2007;33(2):142-53. [CrossRef] | [Google Scholar]

- Piotrowski D.. Sukuk on the socially responsible investments market. Eurasian Bus Perspect.. 2020;12(2):357-67. [CrossRef] | [Google Scholar]

- Saeed M, Elnahass M, Izzeldin M, Tsionas M.. Yield spread determinants of sukuk and conventional bonds. Econ Modell.. 2021:105 [CrossRef] | [Google Scholar]

- Nasir A, Farooq U, Khan KI, Khan AA.. Congruity or dispel? A segmented bibliometric analysis of Sukuk structures. Int J Islam Middle East Financ Manag.. 2022 [CrossRef] | [Google Scholar]

- Zain Mohd NR, Hasan A, Yusof SAM, Engku Ali ERA.. Combating climate change in Malaysia: green sukuk and its potential. Handb res Islam Soc Financ Econ Recover After a Glob Heal Cris IGI Glob.. 2021:264-79. [CrossRef] | [Google Scholar]

- Hassan MK, Aliyu S, Paltrinieri A, Khan A.. A review of Islamic investment literature. Econ Pap.. 2019;38(4):345-80. [CrossRef] | [Google Scholar]

- Masih M, Kamil NK, Bacha OI.. Issues in Islamic equities: A literature survey. Emerg Mark Financ Trade.. 2018;54(1):1-26. [CrossRef] | [Google Scholar]

- Delle AF, Panetta IC.. Islamic stock market versus conventional: are Islamic investing a ‘Safe Haven’ for investors? A systematic literature review. Pacific-Basin Finan J.. 2020;64 [CrossRef] | [Google Scholar]

- Miskam S, Yaakub NI, Hamid MA.. Shari’ah governance framework in Islamic capital market: a review of the literature. Adv Sci Lett.. 2017;23(1):11-4. [CrossRef] | [Google Scholar]

- Paltrinieri A, Hassan MK, Bahoo S, Khan A.. A bibliometric review of sukuk literature. Int Rev Econ Finan.. 2023;86:897-918. [CrossRef] | [Google Scholar]

- Rahman M, Isa CR, Tu TT, Sarker M, Masud MA.. A bibliometric analysis of socially responsible investment sukuk literature. Asian J Sustain Soc Responsib.. 2020;5(1) [CrossRef] | [Google Scholar]

- Ha DN, Vu D, Linh C, Thi V, Thao B, Thang NT, et al. Bibliometric research on youth entertainment activities in social media between 2000 and 2021 from Scopus. J Scientometr Res.. 2021;10(3):337-47. [CrossRef] | [Google Scholar]

- Prakash C, Dwivedi S.. Trends in political campaigning research-A bibliometric literature analysis. J Scientometr Res.. 2022;11(2):262-71. [CrossRef] | [Google Scholar]

- Santos M, Simoes M.. Mapping social policy in economics research: an analysis of core journals. J Scientometr Res.. 2021;10(2):235-44. [CrossRef] | [Google Scholar]

- Chhatoi BP, Sahoo SP, Nayak DP.. Assessing the academic journey of ‘financial inclusion’ from 2000 to 2020 through bibliometric analysis. J Scientometr Res.. 2021;10(2):148-59. [CrossRef] | [Google Scholar]

- Le T vu, Pham H hung, Tran VB.. A Bibliometric Analysis of Studies on ‘Start-up Success’ Covering the Period. J Scientometr Res.. 2022;Array(2):212-25. [CrossRef] | [Google Scholar]

- Uluyol B.. A comprehensive empirical and theoretical literature survey of Islamic bonds (sukuk). J Sustain Finan Invest.. 2021:1-23. [CrossRef] | [Google Scholar]

- Alam Ns, Rizvi SA. Islamic Capital Market Research. Past trends and future considerations;. 2016:1-123. [CrossRef] | [Google Scholar]

- Shafi RM, Tan YL.. Evolution in Islamic capital market: a bibliometric analysis. J Islam Acc Bus Res.. 2023 [CrossRef] | [Google Scholar]

- Supriani I, Iswati S, Bella FI, Tumewang YK.. A bibliometric analysis of zakat literature from 1964 to 2021. J Islam Econ Laws.. 2022;5(2):263-96. [CrossRef] | [Google Scholar]

- Firmansyah EA, Faisal YA.. Bibliometric analysis of Islamic economics and finance journals in Indonesia. Al-Muzara’Ah.. 2020;7(2):17-26. [CrossRef] | [Google Scholar]

- da Silva RF, de Souza GF.. Mapping the literature on asset management: A bibliometric analysis. J Scientometr Res.. 2021;10(1):27-36. [CrossRef] | [Google Scholar]

- Kulkarni AV, Aziz B, Shams I, Busse JW.. Comparisons of citations in Web of Science, Scopus, and Google Scholar for articles published in general medical journals. JAMA.. 2009;302(10):1092-6. [PubMed] | [CrossRef] | [Google Scholar]

- Napitupulu D.. Analysis of E-government research A bibliometric analysis of E-government research. Res Cent Sci Technol Innov Policy Manag.. 2021:6-11. [PubMed] | [CrossRef] | [Google Scholar]

- Athief FHN, Ma’ruf A, Zakiy FS.. Surviving amidst pandemic: Indonesian Islamic microfinance experience. Int J Adv Appl Sci.. 2023;10(3):119-29. [CrossRef] | [Google Scholar]

- Hassan MK, Alshater MM, Hasan R, Bhuiyan AB.. Islamic microfinance: A bibliometric review. Glob Finan J.. 2021;49:100651 [CrossRef] | [Google Scholar]

- Karbhari Y, Naser K, Shahin Z.. Problems and challenges facing the Islamic banking system in the west: the case of the UK. Thunderbird Int Bus Rev.. 2004;46(5):521-43. [CrossRef] | [Google Scholar]

- Naughton S, Naughton T.. Religion, ethics and stock trading: the case of an Islamic equities market. J Bus Ethics.. 2000;23(2):145-59. [CrossRef] | [Google Scholar]

- Smolarski J, Schapek M, Tahir MI.. Permissibility and use of options for hedging purposes in Islamic finance. Thunderbird Int Bus Rev.. 2006;48(3):425-43. [CrossRef] | [Google Scholar]

- Jobst A, Kunzel P, Mills P, Sy A.. Islamic bond issuance: what sovereign debt managers need to know. Int J Islam Middle East Financ Manag.. 2008;1(4):330-44. [CrossRef] | [Google Scholar]

- Selim TH.. An Islamic capital asset pricing model. Humanomics.. 2008;24(2):122-9. [CrossRef] | [Google Scholar]

- Yusof RM, Abd S., Majid M.. Towards an Islamic international financial hub: the role of Islamic capital market in Malaysia. Int J Islam Middle East Financ Manag.. 2008;1(4):313-29. [CrossRef] | [Google Scholar]

- Abdul Aziz RP, Gintzburger AS.. Equity-based, asset-based and asset-backed transactional structures in Shari’a-compliant financing: reflections on the current financial crisis. Econ Pap.. 2009;28(3):270-8. [CrossRef] | [Google Scholar]

- Kassim SH.. Global financial crisis and the integration of Islamic stock markets in developed and developing countries. Asian Acad Manag J Acc Financ.. 2013;9(2):75-94. [CrossRef] | [Google Scholar]

- Abdul Karim B, Akila M, Kassim N, Affendy Arip M.. The subprime crisis and Islamic stock markets integration. Int J Islam Middle East Financ Manag.. 2010;3(4):363-71. [CrossRef] | [Google Scholar]

- Mohd MA, Nawawi AH.. Causality linkages between USA and Asian Islamic stock markets. In: ISBEIA 2011 – 2011 IEEE Symposium on Business, Engineering and Industrial Applications;. 2011:123-8. [CrossRef] | [Google Scholar]

- Ho CS, Abd Rahman NA, Yusuf NH, Zamzamin Z.. Performance of global Islamic versus conventional share indices: international evidence. Pacific-Basin Finan J.. 2014;28:110-21. [CrossRef] | [Google Scholar]

- Dewandaru G, Rizvi SA, Masih R, Masih M, Alhabshi SO.. Stock market co-movements: Islamic versus conventional equity indices with multi-timescales analysis. Econ Syst.. 2014;38(4):553-71. [CrossRef] | [Google Scholar]

- Al-Khazali OM, Leduc G, Alsayed MS.. A market efficiency comparison of Islamic and non-Islamic stock indices. Emerg Mark Financ Trade.. 2016;52(7):1587-605. [CrossRef] | [Google Scholar]

- Ahmed WM.. Int Econ. How do Islamic versus conventional equity markets react to political risk? Dynamic panel evidence. International Economics.. 2018;156:284-304. [CrossRef] | [Google Scholar]

- Ben Rejeb A, Arfaoui M.. Do Islamic stock indexes outperform conventional stock indexes? A state space modeling approach. Eur J Manag Bus Econ.. 2019;28(3):301-22. [CrossRef] | [Google Scholar]

- Sherif M.. The impact of coronavirus (COVID-19) outbreak on faith-based investments: an original analysis. J Behav Exp Finance.. 2020;28:100403 [PubMed] | [CrossRef] | [Google Scholar]

- Naeem MA, Sehrish S, Costa MD.. COVID-19 pandemic and connectedness across financial markets. Pac Acc Rev.. 2020;33(2):165-78. [PubMed] | [CrossRef] | [Google Scholar]

- Hasan MB, Mahi M, Hassan MK, Bhuiyan AB.. Impact of COVID-19 pandemic on stock markets: conventional vs. Islamic indices using wavelet-based multi-timescales analysis. North Am J Econ Finan.. 2021;58 [CrossRef] | [Google Scholar]

- Hassan MK, Djajadikerta HG, Choudhury T, Kamran M.. Safe havens in Islamic financial markets: COVID-19 versus GFC. Glob Finan J.. 2022;54:100643 [CrossRef] | [Google Scholar]

- Bahloul S, Mroua M, Naifar N, Naifar N.. Are Islamic indexes, Bitcoin and gold, still ‘safe-haven’ assets during the COVID-19 pandemic crisis?. Int J Islam Middle East Financ Manag.. 2022;15(2):372-85. [CrossRef] | [Google Scholar]

- Kok S, Giorgioni G, Laws J.. Performance of Shariah-Compliant Indices in London and NY Stock Markets and their potential for diversification. Int J Monet Econ Finan.. 2009;2(3/4):398-408. [CrossRef] | [Google Scholar]

- Abumustafa NI, Al-Abduljader ST.. Investigating the implications of derivative securities in emerging stock markets: the Islamic perspective. J Deriv Hedge Funds.. 2011;17(2):115-21. [CrossRef] | [Google Scholar]

- Issoufou C, Oseni UA.. The application of third party guarantee in structuring Ṣukūk in the Islamic capital market: A preliminary literature survey. Mediterr J Soc Sci.. 2015;6(5):130-8. [CrossRef] | [Google Scholar]

- Muhamad Sori Z, Mohamad S, Al Homsi M.. View from practice: stock market reaction to sukuk credit rating changes in Malaysia. Thunderbird Int Bus Rev.. 2019;61(5):659-67. [CrossRef] | [Google Scholar]

- Ebrahim MS, Rahman S.. On the pareto-optimality of futures contracts over Islamic forward contracts: implications for the emerging Muslim economies. J Econ Behav Organ.. 2005;56(2):273-95. [CrossRef] | [Google Scholar]

- Baydoun N, Anwar SA.. Carving a service quality niche for Sukuk: A case study of National Bonds in the UAE. J Glob Bus Adv.. 2018;11(3):351-75. [CrossRef] | [Google Scholar]

- Al-Ali AH, Yousfi IA.. Investigation of Jordanian Islamic and conventional banks’ stability: evidence from the recent financial crisis. Eur J Econ Finan Admin Sci.. 2012;44:45-65. [CrossRef] | [Google Scholar]

- Ng A, Ibrahim M, Mirakhor A.. On building social capital for Islamic finance. Int J Islam Middle East Financ Manag.. 2015;8(1):2-19. [CrossRef] | [Google Scholar]

- Hussain M, Shahmoradi A, Turk R.. An overview of Islamic finance. J Intl Econ Comm Policy.. 2016;7(1) [CrossRef] | [Google Scholar]

- Aggarwal RK, Yousef T.. Islamic banks and investment financing. J Money, Credit Bank.. 2000;32(1):93-120. [CrossRef] | [Google Scholar]

- Hayat R, Kraeussl R.. Risk and return characteristics of Islamic equity funds. Emerg Mark Rev.. 2011;12(2):189-203. [CrossRef] | [Google Scholar]

- Al-Khazali O, Lean HH, Samet A.. Do Islamic stock indexes outperform conventional stock indexes? A stochastic dominance approach. Pacific-Basin Finan J.. 2014;28:29-46. [CrossRef] | [Google Scholar]

- Alam A, Ratnasari RT, Ainul Qolbi F., Athief FHN.. Efficiency studies of the sharia insurance industry: A systematic literature review.. 2022:13 [CrossRef] | [Google Scholar]

- Apriantoro MS, Mellinia R, Maheswari SG, Hudaifah.. Islamic financial research directions during pandemic: A bibliometric analysis. At-Taradhi J stud ekon. XIII.. 2022;2:75-97. [CrossRef] | [Google Scholar]

- Boujelbène Abbes M.. Risk and return of Islamic and conventional indices. Int J Euro-Mediter Stud.. 2012;5(1):1-23. [CrossRef] | [Google Scholar]

- Hkiri B, Hammoudeh S, Aloui C, Yarovaya L.. Are Islamic indexes A safe haven for investors? An analysis of total, directional and net volatility spillovers between conventional and Islamic indexes and importance of crisis periods. Pacific-Basin Finan J.. 2017;43:124-50. [CrossRef] | [Google Scholar]

- Erdoğan S, Gedikli A, Çevik Eİ. Volatility spillover effects between Islamic stock markets and exchange rates: evidence from three emerging countries. Borsa Istanb Rev.. 2020;20(4):322-33. [CrossRef] | [Google Scholar]

- Al Rahahleh N, Akguc S, Abalala T.. Dow Jones Islamic Index firms: how profitable are they?. Int J Islam Middle East Financ Manag [Internet].. 2020;14(3):463-81. [CrossRef] | [Google Scholar]

- Hussain HI, Ali M, Hassan MK, El-Khatib R.. Asymmetric capital structure speed of adjustment, equity mispricing and Shari’ah compliance of Malaysian firms. Int Rev Econ Finan [Internet].. 2023;86:965-75. [CrossRef] | [Google Scholar]

- Umar Z.. Islamic vs conventional equities in a strategic asset allocation framework. Pacific-Basin Finan J [Internet].. 2017;42:1-10. [CrossRef] | [Google Scholar]

- Ashraf D, Shari’ah D.. Does Shari’ah Screening cause abnormal returns? Empirical evidence from Islamic equity indices. J Bus Ethics [Internet].. 2016;134(2):209-28. [CrossRef] | [Google Scholar]

- Ahmed N, Farooq O.. Does the degree of Shari’ah compliance affect the volatility? Evidence from the MENA region. Res Int Bus Finan [Internet].. 2018;45:150-7. [CrossRef] | [Google Scholar]

- Mahfooz S bin, Ahmed H.. Sharīah investment screening criteria: A critical review. J King Abdulaziz Univ Islam Econ.. 2014;27(1):111-45. [CrossRef] | [Google Scholar]